Analysts Forecast Strong Upside for Fidelity MSCI Information Technology ETF (FTEC)

A recent analysis of ETF Channel reveals that the Fidelity MSCI Information Technology Index ETF (Symbol: FTEC) has an implied target price of $214.00 per unit based on its underlying holdings.

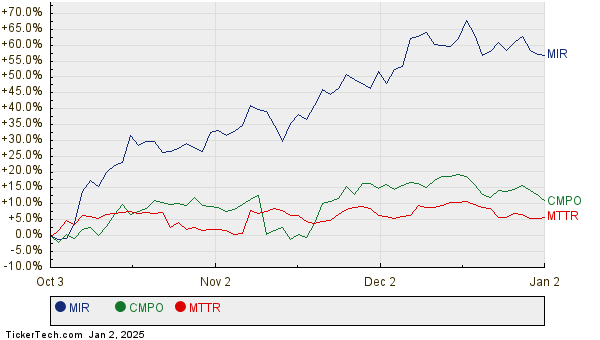

Currently, FTEC trades at around $184.88 per unit, suggesting a potential upside of 15.75%. This positive outlook is largely driven by three prominent holdings: Mirion Technologies Inc. (Symbol: MIR), Composecure Inc. (Symbol: CMPO), and Matterport Inc. (Symbol: MTTR). Each of these stocks has notable upside potential relative to their respective analyst target prices.

For instance, Mirion Technologies shares recently traded at $17.45, yet analysts have set an average target at $20.50, which represents a 17.48% increase. Similarly, Composecure shares priced at $15.33 have a target of $17.94, indicating a potential 17.01% upside. Finally, Matterport’s current price of $4.74 aligns with a target of $5.50, translating to an expected rise of 16.03%. Below is a chart comparing the stock performance of these three companies over the past year:

Below is a summary table displaying the current analyst target prices mentioned:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Information Technology Index ETF | FTEC | $184.88 | $214.00 | 15.75% |

| Mirion Technologies Inc | MIR | $17.45 | $20.50 | 17.48% |

| Composecure Inc | CMPO | $15.33 | $17.94 | 17.01% |

| Matterport Inc | MTTR | $4.74 | $5.50 | 16.03% |

Are analysts’ targets justified, or do they hold an overly optimistic view on these stocks over the next 12 months? It’s essential for investors to research whether analysts have valid reasons for their predictions or if they are lagging behind crucial industry developments. A high target relative to a current price might reflect future optimism, but it could also lead to downward adjustments if the targets are outdated. These considerations merit further investigation by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• O Dividend Growth Rate

• NVCR market cap history

• Funds Holding STX

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.