Analysts Predict Potential Gains for Vanguard Small-Cap Value ETF

Our analysis at ETF Channel compares ETF holdings with average analyst targets, revealing potential for the Vanguard Small-Cap Value ETF (Symbol: VBR).

Current Status of VBR and Analyst Predictions

The implied analyst target price for the Vanguard Small-Cap Value ETF is $229.43 per unit, while it is currently trading at approximately $203.66. This suggests a possible upside of 12.65% based on analysts’ forecasts for its underlying holdings.

Underlying Holdings with Significant Upside Potential

Three holdings within VBR stand out due to their potential price increases. Day One Biopharmaceuticals Inc (Symbol: DAWN) has a recent price of $12.40, but analysts estimate a target price of $35.78—indicating an upside of 188.52%. Similarly, AST SpaceMobile Inc (Symbol: ASTS) is currently at $20.99, with a target price of $41.17, suggesting a potential increase of 96.16%. Lastly, Brc Inc (Symbol: BRCC) trades at $3.04, yet analysts predict it could reach $5.71, representing an 87.76% upside.

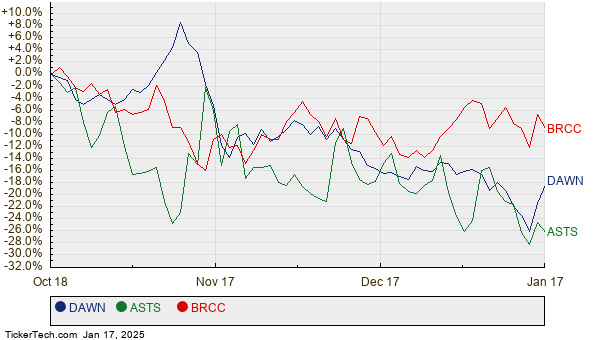

Performance Comparison of Selected Stocks

Below is a twelve-month price history chart that illustrates the stock performance of DAWN, ASTS, and BRCC:

Summary of Analyst Targets

Here is a summary table highlighting the recent prices and target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Small-Cap Value ETF | VBR | $203.66 | $229.43 | 12.65% |

| Day One Biopharmaceuticals Inc | DAWN | $12.40 | $35.78 | 188.52% |

| AST SpaceMobile Inc | ASTS | $20.99 | $41.17 | 96.16% |

| Brc Inc | BRCC | $3.04 | $5.71 | 87.76% |

Considerations for Investors

This brings into question whether analysts’ targets are achievable or too ambitious. Investors should examine the rationale behind these targets and consider the latest company and industry developments. While high target prices might reflect optimism, they could also lead to adjustments if expectations are unrealistic. Thorough research is essential for making informed investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding JRS

• Royal Caribbean Group DMA

• Institutional Holders of AIRE

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.