When examining the contents of ETFs in their coverage universe, ETF Channel has delved deep into the trading price of each holding as compared to the average analyst 12-month forward target price. This meticulous analysis has culminated in the revelation that the iShares U.S. Regional Banks ETF (IAT), is projected to hit a lofty $46.19 per unit, as per the strategic calculations of discerning analysts.

Currently, with IAT hovering around a moderate price of nearly $41.96 per unit, analysts foresee a potential 10.09% upswing for this ETF as they gaze towards the average analyst targets of the underlying holdings. Noteworthy among these holdings are Glacier Bancorp, Inc. (GBCI), KeyCorp (KEY), and M & T Bank Corp (MTB), each demonstrating significant upside according to analyst projections.

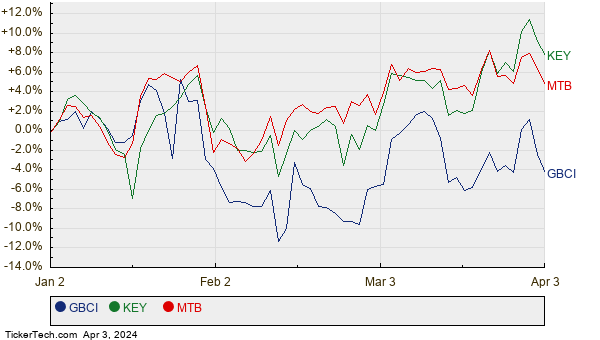

The future looks bright for GBCI, with an anticipated rise of 14.56% from the current share price of $37.97 to a projected target of $43.50. Similarly, KEY hints at a 13.30% expansion from a recent share price of $15.26 to a speculated average analyst target price of $17.29, while MTB is envisaged to climb to a target price of $158.08/share, translating to a 12.39% uplift from the present price of $140.65. A glance at a twelve-month price history chart portraying the stock performance of GBCI, KEY, and MTB mirrors this optimistic outlook.

In the grand scheme of things, the trio of GBCI, KEY, and MTB collectively represent 8.44% of the iShares U.S. Regional Banks ETF. A comprehensive summary table displaying the current analyst target prices for these stocks provides a snapshot of the expected accomplishments.

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Regional Banks ETF | IAT | $41.96 | $46.19 | 10.09% |

| Glacier Bancorp, Inc. | GBCI | $37.97 | $43.50 | 14.56% |

| KeyCorp | KEY | $15.26 | $17.29 | 13.30% |

| M & T Bank Corp | MTB | $140.65 | $158.08 | 12.39% |

Are these optimistic projections justified or merely overly ambitious? Do analysts possess a valid rationale for their targets, or do they lag behind in interpreting recent company and industry shifts? A high price target relative to the stock’s trading price could signify a rosy future outlook, yet it could also pave the way for target price downgrades if the targets are perceived as relics. These questions beckon further investor scrutiny to uncover the true potential concealed within these forecasts.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

More Insightful Views:

ITGR YTD Return

Top Ten Hedge Funds Holding BDBD

PTI YTD Return

Ponder over the perspectives expressed here, where the author’s insights may veer distinct from those of Nasdaq, Inc. It’s all a tapestry of forecasts and conjectures in the intricate realm of financial markets.