AMD Shares Struggle Despite AI Gains: What Analysts Recommend

Current Performance Overview: Advanced Micro Devices AMD has seen its stock lag behind the Nasdaq 100 this year, despite capturing market share in the AI sector. Investors are left wondering if it’s time to buy or sell, particularly given the stock’s recent downturn signals.

Market Analysis: On Tuesday, AMD’s stock closed at $126.29, which initially appears favorable as it is above the eight-day simple moving average of $123.48. Yet, data from Benzinga Pro reveals that it has traded below longer-term averages: the 20-day moving average of $130.77, the 50-day moving average of $140.38, and the 200-day moving average of $154.50.

This situation paints a downtrend picture. Although the relative strength index (RSI) stands at 40.31, indicating a neutral position, it suggests that the stock is neither overbought nor oversold.

Implications for AMD: The year 2024 has been a mixed bag for AMD. The introduction of new GPUs has spurred significant growth in data centers, helping the company gain traction against Nvidia’s H100, mainly due to better stock availability and competitive pricing. However, the gaming and embedded segments have seen a slowdown, impacting overall growth rates.

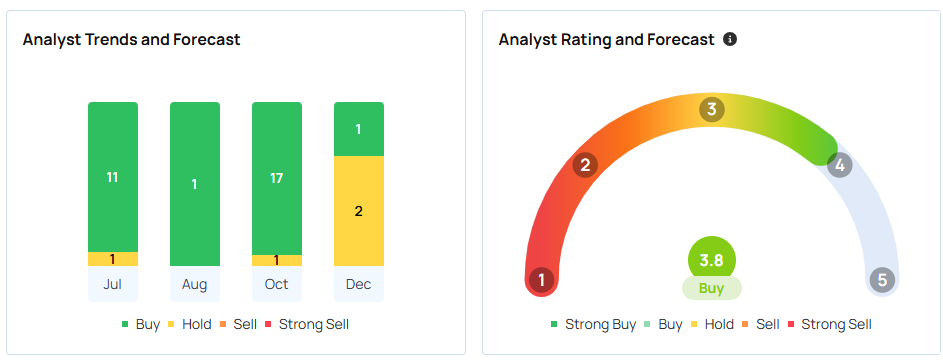

According to Benzinga, AMD currently enjoys a consensus ‘buy’ rating, with an average price target of $195.07 based on the assessments of 30 analysts.

The highest target price, set at $265 by Melius Research on March 8, reflects optimism about AMD’s potential. Analysts at Melius suggest AMD shares similarities with previous successes seen by Nvidia Corporation NVDA. However, they also caution that while AMD’s growth is notable, it does not pose a significant threat to Nvidia’s leading position. Nvidia’s expansive ecosystem and ongoing market growth indirectly benefit AMD by enlarging the high-performance AI chip market.

Rosenblatt has identified AMD as a top stock pick for the first half of 2025, predicting momentum from CPU and GPU market share gains alongside a broader recovery in non-AI segments moving into 2025. Notably, analysts recognize this upcoming opportunity, which could yield double-digit gains in GPU compute and AI inference markets, particularly leveraging Xilinx’s existing advantages and chiplet innovations.

Conversely, BofA Securities has downgraded its rating on AMD from ‘buy’ to ‘neutral,’ lowering the target price from $180 to $155 per share on December 9. This downgrade reflects concerns that AMD will capture just 4% of the projected $200 billion AI accelerator market by 2025, in stark contrast to Nvidia’s expected 80%+ share. These factors raise questions about AMD’s growth prospects in light of anticipated weakness in the PC processor market during the first half of 2025.

Among other analyst evaluations, the average price target of $164.33, set by firms like Morgan Stanley, BofA Securities, and Mizuho, implies a potential 30.81% upside for AMD.

Stock Movements: On Thursday, AMD shares fell 0.24% to $125.99 in premarket trading. The stock has seen an overall decline of 8.87% this year, significantly underperforming the Nasdaq 100, which has gained 31.76% during the same period.

Related Insights:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs