Analyst Insights: Potential Upside for FXR and Key Holdings

ETF Channel has analyzed the underlying holdings of selected ETFs to compare their trading prices against the average analyst 12-month forward target prices. For the First Trust Industrials/Producer Durables AlphaDEX Fund ETF (Symbol: FXR), the findings reveal an implied analyst target price of $82.85 per unit based on these holdings.

Current Trading and Analyst Perspectives

FXR is currently trading at approximately $75.49 per unit, suggesting analysts anticipate a potential upside of 9.75% based on the average target prices of the ETF’s underlying assets. Among these holdings, three stocks stand out with significant upside potential: Flowserve Corp (Symbol: FLS), Brunswick Corp. (Symbol: BC), and L3Harris Technologies Inc (Symbol: LHX).

Flowserve’s shares have recently been priced at $52.64, but analysts project a target of $59.00, which reflects a potential upside of 12.08%. Brunswick Corp. has a recent trading price of $79.74, with an analyst target of $88.53, indicating an upside of 11.03%. In addition, L3Harris is priced at $247.47, with analysts forecasting a target of $274.00, a potential increase of 10.72%.

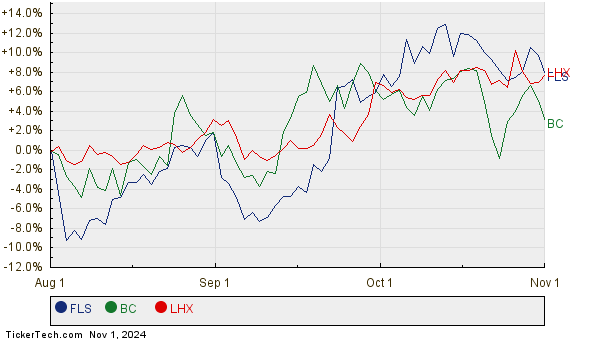

Below is a twelve-month price history chart that compares the stock performance of FLS, BC, and LHX:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Industrials/Producer Durables AlphaDEX Fund ETF | FXR | $75.49 | $82.85 | 9.75% |

| Flowserve Corp | FLS | $52.64 | $59.00 | 12.08% |

| Brunswick Corp. | BC | $79.74 | $88.53 | 11.03% |

| L3Harris Technologies Inc | LHX | $247.47 | $274.00 | 10.72% |

Evaluating Analysts’ Projections

Are these analyst targets reasonable, or merely optimistic? It’s important for investors to contemplate whether analysts are adequately considering recent market trends and developments within the companies. A high target price relative to a stock’s current price might indicate optimism, but it could also lead to future downgrades if these targets are based on outdated information. Investors should conduct thorough research before drawing conclusions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• NFE Historical Stock Prices

• GRT Videos

• Top Ten Hedge Funds Holding EXPI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.