Analysts See Potential Growth in First Trust BuyWrite Income ETF

At ETF Channel, we analyzed the holdings of various ETFs to assess their potential against analyst price targets. The results for the First Trust BuyWrite Income ETF (Symbol: FTHI) reveal an implied analyst target price of $26.03 per unit.

Current Trading and Analyst Outlook

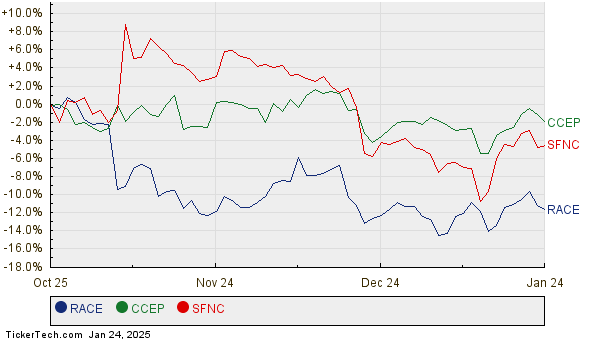

FTHI is currently trading around $23.63 per unit, suggesting analysts anticipate a potential upside of 10.14% based on the average targets of its underlying holdings. Among these holdings, three stocks are particularly noteworthy for their expected growth: Ferrari NV (Symbol: RACE), Coca-Cola Europacific Partners plc (Symbol: CCEP), and Simmons First National Corp (Symbol: SFNC). Although RACE is priced at $429.98 per share, analysts predict a robust increase of 20.33%, bringing the average target to $517.38. Likewise, CCEP shows a possible upside of 11.28% from its current price of $76.31, with its target set at $84.92. Lastly, SFNC is expected to climb to a target price of $24.80, reflecting a 10.71% increase from its recent price of $22.40.

Analyst Target Summary

Here’s a summary of the analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust BuyWrite Income ETF | FTHI | $23.63 | $26.03 | 10.14% |

| Ferrari NV | RACE | $429.98 | $517.38 | 20.33% |

| Coca-Cola Europacific Partners plc | CCEP | $76.31 | $84.92 | 11.28% |

| Simmons First National Corp | SFNC | $22.40 | $24.80 | 10.71% |

Investor Considerations

This raises important questions for investors: Are these analyst targets reasonable, or are they overly optimistic? It is essential to consider whether analysts have a valid rationale for their predictions or if they are failing to account for recent trends in the industry or individual companies. A target that seems high compared to current stock prices can indicate optimism but might also point to potential downgrades if based on outdated information. Further research will be vital for investors navigating these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• TK market cap history

• UNCY Stock Predictions

• DLB Price Target

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.