Analysts See Significant Potential in Vanguard Industrials ETF and Its Holdings

In a recent analysis at ETF Channel, we examined the underlying holdings of various ETFs, comparing their trading prices to the average analyst forecasts for the next 12 months. The findings for the Vanguard Industrials ETF (Symbol: VIS) reveal an implied analyst target price of $295.64 per unit.

Current Trading Price and Potential Upside

Currently, VIS is trading around $265.78 per unit. This indicates an 11.23% upside potential, suggesting that analysts are optimistic about the ETF’s future based on the underlying stocks. Notably, three of these stocks show promising upside potential relative to their analyst targets: MAXIMUS Inc. (Symbol: MMS), Transcat Inc. (Symbol: TRNS), and BrightView Holdings Inc. (Symbol: BV).

Stocks with Upside Potential

MAXIMUS shares are currently priced at $70.00, which is significantly lower than the average target price of $90.00, indicating a potential increase of 28.57%. Similarly, Transcat’s shares at $77.81 show a 22.09% upside to the target of $95.00. In the case of BrightView, the recent price of $15.04 is about 18.63% lower than the analysts’ target of $17.84.

Performance Overview

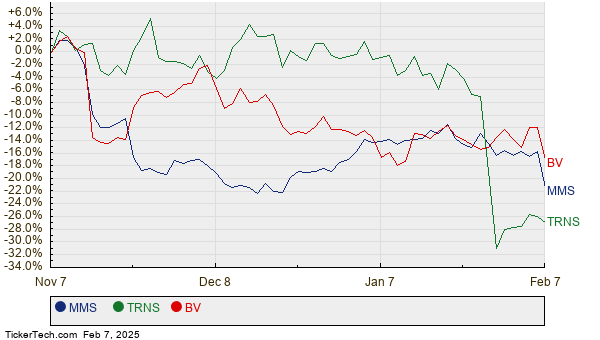

Below is a chart portraying the twelve-month stock performance of MMS, TRNS, and BV:

Analyst Target Price Summary

Here’s a summary table of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Industrials ETF | VIS | $265.78 | $295.64 | 11.23% |

| MAXIMUS Inc. | MMS | $70.00 | $90.00 | 28.57% |

| Transcat Inc | TRNS | $77.81 | $95.00 | 22.09% |

| BrightView Holdings Inc | BV | $15.04 | $17.84 | 18.63% |

Questions for Investors

These findings prompt important questions: Are analysts’ projections well-founded, or could they be overly optimistic? It’s essential for investors to consider recent developments within these companies and their sectors. While high targets can indicate strong future expectations, they may also reflect outdated assessments. Additional research is advisable for investors looking to navigate these insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• BankInvestor

• Top Ten Hedge Funds Holding OKTA

• AIR Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.