Vanguard Growth ETF Offers Promising Analyst Upside

The Vanguard Growth ETF (Symbol: VUG) showcases potential gains based on recent analyst evaluations.

In our analysis at ETF Channel, we assessed the trading prices of the ETF’s underlying holdings and compared them to analysts’ average 12-month target prices. For VUG, the estimated target price is $438.94 per unit, implying a notable upside for investors.

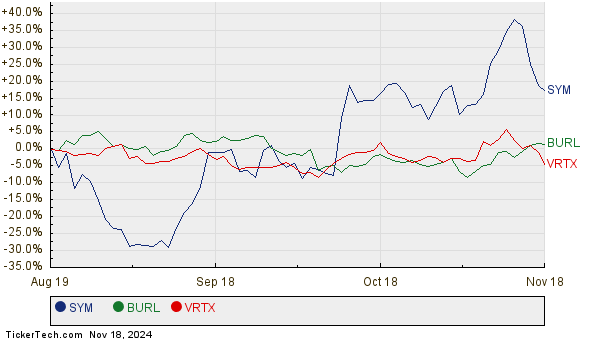

Currently trading around $397.83 per unit, analysts project a potential increase of 10.33% for VUG based on its underlying assets. Certain holdings within VUG stand out due to their significant upside expectations. For example, Symbotic Inc (Symbol: SYM) is priced at $29.49 per share but has a target price that suggests a 39.25% increase, reaching $41.07. Burlington Stores Inc (Symbol: BURL) currently trades at $268.94, but analysts foresee a 13.10% rise to a target of $304.17. Vertex Pharmaceuticals, Inc. (Symbol: VRTX), priced recently at $465.70, has an anticipated target of $519.45, indicating an 11.54% upside.

Below is a chart of the twelve-month price history, showcasing the performance of SYM, BURL, and VRTX:

Here is a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Growth ETF | VUG | $397.83 | $438.94 | 10.33% |

| Symbotic Inc | SYM | $29.49 | $41.07 | 39.25% |

| Burlington Stores Inc | BURL | $268.94 | $304.17 | 13.10% |

| Vertex Pharmaceuticals, Inc. | VRTX | $465.70 | $519.45 | 11.54% |

Are these analyst targets realistic, or do they indicate an overly optimistic view of the market? Investors should investigate whether analysts are accurately capturing recent changes in the companies and industries involved. While high price targets can suggest confidence in future growth, they may also lead to downward adjustments if those targets fail to materialize.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

‧ Funds Holding GSI

‧ ZSL Videos

‧ Institutional Holders of NRUC

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.