JPMorgan Active Growth ETF Shows Potential for 11% Upswing

New analysis reveals that the JPMorgan Active Growth ETF (Symbol: JGRO) holds promise, with an implied analyst target price suggesting considerable upside. See the details below.

Analyzing the ETF holdings at ETF Channel, we found that the current implied analyst target price for JGRO stands at $90.65 per unit. This contrasts sharply with its recent trading price of $81.35 per unit, indicating that analysts believe it could rise by 11.43% over the next year based on the underlying holdings’ average analyst targets.

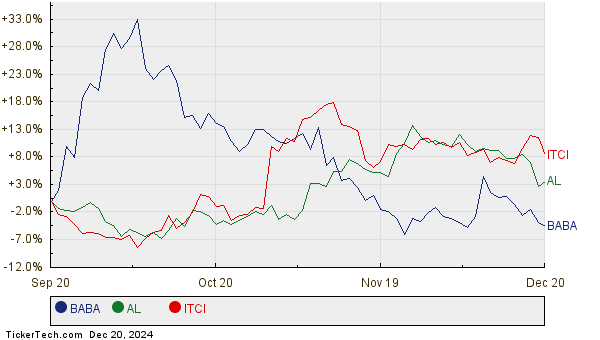

Among JGRO’s holdings, several stocks offer significant upside potential. For instance, Alibaba Group Holding Ltd (Symbol: BABA) is currently priced at $84.31; however, analysts predict a target price of $119.89, marking a potential increase of 42.20%. Also, Air Lease Corp (Symbol: AL) could see a 21.91% rise from its current price of $47.46, with an average target of $57.86. Intra-Cellular Therapies Inc (Symbol: ITCI) is expected to reach a target of $101.27, representing a 20.35% upside from its recent price of $84.14. Below is a 12-month price history chart highlighting the performance of BABA, AL, and ITCI:

Here is a summary of the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| JPMorgan Active Growth ETF | JGRO | $81.35 | $90.65 | 11.43% |

| Alibaba Group Holding Ltd | BABA | $84.31 | $119.89 | 42.20% |

| Air Lease Corp | AL | $47.46 | $57.86 | 21.91% |

| Intra-Cellular Therapies Inc | ITCI | $84.14 | $101.27 | 20.35% |

The outlook for these stocks raises important questions. Are the analysts justified in their targets, or could they be too optimistic about future performance? It is crucial for investors to research recent company and industry developments closely. A high price target compared to the stock’s current price can indicate optimism but may also lead to potential target downgrades if expectations aren’t met. Careful examination is warranted.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Consumer Stocks Hedge Funds Are Selling

• Institutional Holders of LVOL

• Top Ten Hedge Funds Holding MRRL

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.