SPDR Portfolio S&P 1500 ETF Analysts See Strong Growth Ahead

In our analysis at ETF Channel, we’ve examined the trading prices of each holding within the ETFs we cover. We assessed these prices against the average 12-month forward target prices set by analysts. For the SPDR Portfolio S&P 1500 Composite Stock Market ETF (Symbol: SPTM), the result shows an implied analyst target price of $82.80 per unit.

Current Trading Insights

Currently, SPTM trades at approximately $73.68 per unit. This indicates a potential upside of 12.38% based on the analysts’ target prices for its underlying assets. Of particular interest are three holdings within SPTM that analysts believe have significant upside potential: Allegiant Travel Company (Symbol: ALGT), Invitation Homes Inc (Symbol: INVH), and Biolife Solutions Inc (Symbol: BLFS). ALGT’s recent trading price stands at $83.93 per share, while analysts predict a target of $97.18, suggesting a potential increase of 15.79%. Similarly, INVH could rise from its current price of $31.52 to an average target of $36.15, reflecting an upside of 14.70%. Analysts also expect BLFS, currently at $26.72, to reach a target price of $30.50, marking a 14.15% increase.

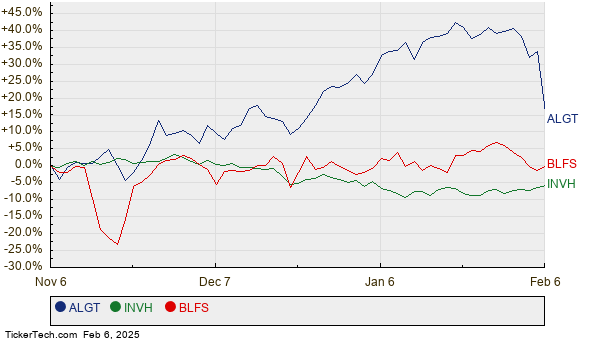

Below is a twelve-month price history chart illustrating the stock performance of ALGT, INVH, and BLFS:

Analyst Target Price Summary

Here’s a summary of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 1500 Composite Stock Market ETF | SPTM | $73.68 | $82.80 | 12.38% |

| Allegiant Travel Company | ALGT | $83.93 | $97.18 | 15.79% |

| Invitation Homes Inc | INVH | $31.52 | $36.15 | 14.70% |

| Biolife Solutions Inc | BLFS | $26.72 | $30.50 | 14.15% |

Market Outlook

Are these analyst targets realistic, or are they perhaps too optimistic? Investors might ponder whether analysts are providing valid rationales for their projections or if they are lagging behind recent developments in the companies and their industries. Generally, a high target price compared to a stock’s trading price may signal optimism about its future; however, it can also lead to price downgrades if those targets are based on outdated assessments. Therefore, thorough investor research is essential.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• RDHL Options Chain

• BXS Stock Predictions

• NXU YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.