Analysts See Potential Growth for Fidelity MSCI Health Care Index ETF

Evaluating the Fidelity MSCI Health Care Index ETF (Symbol: FHLC) reveals a favorable outlook based on analyst target prices. The implied target price for this ETF stands at $81.90 per unit, significantly higher than its recent trading price of $69.88.

Strong Upside Potential for Underlying Holdings

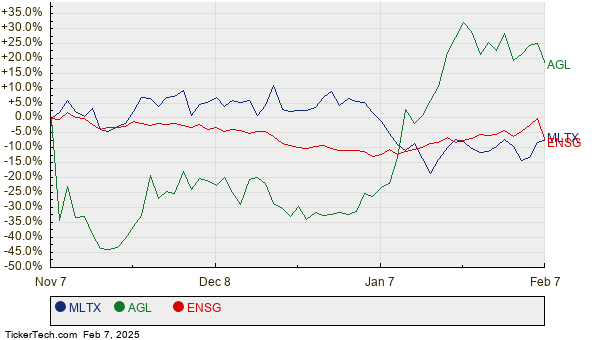

With analysts projecting a 17.21% increase from the current price, FHLC is considered a strong candidate for future gains. Among its underlying holdings, MoonLake Immunotherapeutics (Symbol: MLTX), Agilon Health Inc (Symbol: AGL), and Ensign Group Inc (Symbol: ENSG) stand out for their expected growth. For instance, MLTX, currently trading at $47.11, has an average target of $76.85, suggesting a potential rise of 63.12%. AGL is similarly positioned; its current price of $3.28 corresponds with a target price of $3.98, indicating an upside of 21.28%. Meanwhile, ENSG, trading at $135.91, is estimated to reach $159.83, representing a 17.60% upside.

Below is a twelve-month price history chart comparing the stock performance of MLTX, AGL, and ENSG:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Health Care Index ETF | FHLC | $69.88 | $81.90 | 17.21% |

| MoonLake Immunotherapeutics | MLTX | $47.11 | $76.85 | 63.12% |

| Agilon Health Inc | AGL | $3.28 | $3.98 | 21.28% |

| Ensign Group Inc | ENSG | $135.91 | $159.83 | 17.60% |

Investors may wonder if analysts are justified in their targets or if they are being overly optimistic about these stocks. Understanding the basis for these pricing strategies is essential and warrants further investigation. An optimistic target price could signal future growth but may also lead to downgrades if expectations were set based on outdated information.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• High Dividend Stocks

• Institutional Holders of ELRC

• DOCU Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.