Potential Gains Ahead for WisdomTree U.S. LargeCap Fund ETF

Analysts suggest strong future performance for the ETF compared to its underlying holdings.

At ETF Channel, we’ve analyzed the underlying assets of various ETFs, comparing their current trading prices to average analyst target prices for the next 12 months. For the WisdomTree U.S. LargeCap Fund ETF (Symbol: EPS), the weighted average implied target price stands at $71.75 per unit.

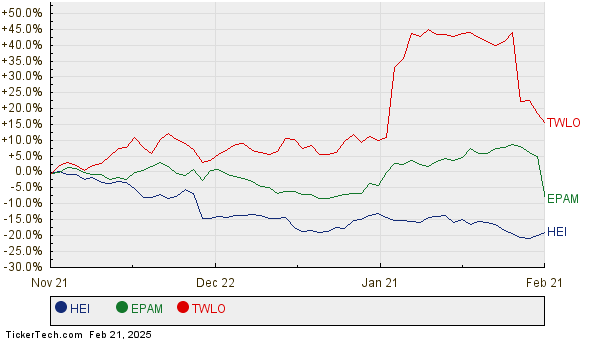

Currently trading at around $63.90 per unit, EPS offers a potential upside of 12.29%, based on projections from analysts regarding its underlying holdings. Notably, three key assets—HEICO Corp (Symbol: HEI), Epam Systems, Inc. (Symbol: EPAM), and Twilio Inc (Symbol: TWLO)—show substantial upside potential relative to their target prices. HEICO, priced at $225.54 per share, has an average target price that is 19.01% higher at $268.42. Likewise, EPAM, trading at $225.07, could rise by 18.80% to an expected $267.39 per share. Analysts anticipate TWLO’s target price to reach $138.88, reflecting a 17.70% increase from its current price of $118.00. Below is a chart detailing the price performance of HEI, EPAM, and TWLO over the past twelve months:

Here’s a summary of key analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. LargeCap Fund ETF | EPS | $63.90 | $71.75 | 12.29% |

| HEICO Corp | HEI | $225.54 | $268.42 | 19.01% |

| Epam Systems, Inc. | EPAM | $225.07 | $267.39 | 18.80% |

| Twilio Inc | TWLO | $118.00 | $138.88 | 17.70% |

Are these projections justified, or are analysts simply being overly optimistic? It’s essential to evaluate whether these price targets are based on solid reasoning or if they reflect outdated information. While a high target price compared to the current share price may indicate optimism, it can also lead to revised downward expectations if market conditions change. Investors should conduct thorough research before making any decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding TEGP

• MCEF Videos

• Top Ten Hedge Funds Holding GEN

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.