Analysts See Strong Potential Upside for HCM Defender 500 ETF

Investors are looking closely at the HCM Defender 500 Index ETF (Symbol: LGH), which is trading below its projected average analyst target price. With substantial upside anticipated, it raises questions about the future performance of its underlying holdings.

The implied analyst target price for LGH, based on its holdings, is $58.29 per unit. Currently, the ETF’s trading price sits at about $53.19 per unit. This suggests that analysts forecast a 9.58% increase in value for the ETF. Specific stocks within the ETF, such as Otis Worldwide Corp (Symbol: OTIS), AMETEK Inc (Symbol: AME), and NIKE Inc (Symbol: NKE), show even more pronounced upside potential. For instance, OTC’s recent price of $93.52 is significantly below its average target price, which stands at $103.18—implying a potential rise of 10.33%. AME and NKE are also poised for upward movement, with expectations of reaching target prices of $201.08 and $84.20 respectively, translating into potential upsides of 10.21% and 10.18% from their recent prices.

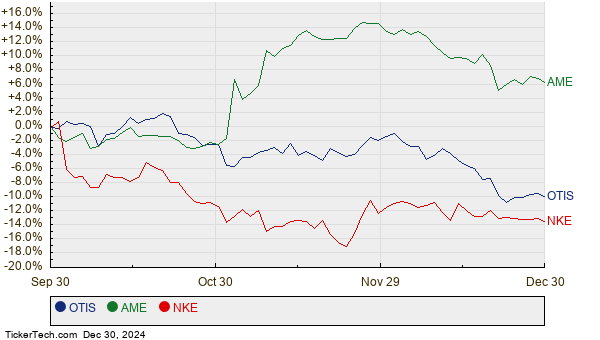

Below is a twelve-month price performance chart showcasing the trends for OTIS, AME, and NKE:

A summary of the current analyst target prices is as follows:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| HCM Defender 500 Index ETF | LGH | $53.19 | $58.29 | 9.58% |

| Otis Worldwide Corp | OTIS | $93.52 | $103.18 | 10.33% |

| AMETEK Inc | AME | $182.45 | $201.08 | 10.21% |

| NIKE Inc | NKE | $76.42 | $84.20 | 10.18% |

As analysts set these targets, the question remains: Are they justified in their optimism, or are they potentially misjudging future stock values? The divergence between actual trading prices and analyst targets can indicate either a strong bullish sentiment or a disconnect from recent trends within the companies and the broader market. Careful investor research is warranted to navigate this terrain.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Market News Video

CVR Split History

Institutional Holders of WCST

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.