Analysts Project Upside for WisdomTree U.S. Quality Growth Fund ETF

The WisdomTree U.S. Quality Growth Fund ETF (Symbol: QGRW) is currently trading at $49.46 per unit. Analysts have calculated an average target price of $54.30 per unit, indicating an upside potential of 9.79%. This suggests that there may still be room for growth in QGRW’s valuation based on the performance of its underlying holdings.

Three notable stocks within QGRW are Vertex Pharmaceuticals, Inc. (Symbol: VRTX), HEICO Corp (Symbol: HEI), and Gartner Inc (Symbol: IT). Each of these companies has a significant upside compared to their average analyst target prices. Vertex has a recent trading price of $447.50, but analysts predict a target of $522.21, which is a 16.69% increase. HEICO’s recent price is $237.24, while its target price is set at $270.58, reflecting a potential upside of 14.05%. Similarly, Gartner, which is trading at $481.77, has an average target price of $546.55, showing an anticipated rise of 13.45%.

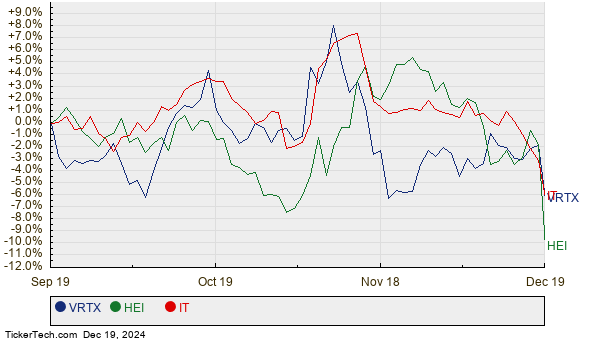

Below, you can find a twelve-month price history chart illustrating the performance of VRTX, HEI, and IT:

Here’s a table summarizing the current analyst target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. Quality Growth Fund ETF | QGRW | $49.46 | $54.30 | 9.79% |

| Vertex Pharmaceuticals, Inc. | VRTX | $447.50 | $522.21 | 16.69% |

| HEICO Corp | HEI | $237.24 | $270.58 | 14.05% |

| Gartner Inc | IT | $481.77 | $546.55 | 13.45% |

Investors may wonder if analysts are being realistic with these price targets, or if they might be overly optimistic. Price targets higher than current trading prices can signal confidence in future performance, but they could also lead to potential downgrades if market conditions change. It may be wise for investors to conduct further research into these stocks and the reasons behind the analysts’ projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• AON DMA

• CLRO Insider Buying

• ETFs Holding JCP

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.