Understanding Wall Street Recommendations for Alibaba (BABA)

Investors frequently look to Wall Street analysts’ recommendations when making decisions about buying, selling, or holding a Stock. Changes in these ratings by brokerage, or sell-side, analysts can significantly influence a stock’s market price. However, the actual impact of these recommendations on stock performance raises important questions.

Before delving into the reliability of brokerage recommendations, let’s examine the current outlook for Alibaba (BABA).

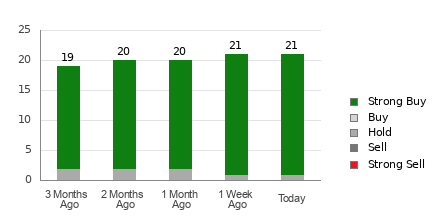

As it stands, Alibaba has an average brokerage recommendation (ABR) of 1.10 on a scale from 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell). This figure is derived from the ratings made by 21 brokerage firms and reflects a strong inclination toward buying, as 20 of those recommendations classify as Strong Buy, making up 95.2% of the total.

Current Trends in BABA Brokerage Recommendations

For more details on price targets and Stock forecasts for Alibaba, check here>>>

While the ABR suggests a favorable outlook for Alibaba, relying on this metric alone isn’t advisable. Research indicates that brokerage recommendations often fail to predict which stocks will appreciate the most in value.

The primary reason for this discrepancy lies in the brokers’ vested interests. Analysts, influenced by their firms, tend to exhibit a strong positive bias in their ratings. In fact, our findings reveal that brokerage firms issue five “Strong Buy” recommendations for every “Strong Sell” rating.

This bias highlights a misalignment of interests between brokerage firms and retail investors. Therefore, using brokerage recommendations solely as a basis for investment decisions can be misleading. It is more effective to combine such insights with personal analysis or other established predictive tools.

The Zacks Rank is one such tool. This proprietary rating system classifies stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) based on earnings estimate revisions. Historical data supports its efficacy in forecasting stock price movements. Using the ABR alongside the Zacks Rank can lead to more informed investment choices.

Distinguishing Between ABR and Zacks Rank

Although both the ABR and the Zacks Rank are rated on a scale of 1 to 5, they represent fundamentally different measures.

The ABR is calculated solely on brokerage recommendations and is often expressed in decimal form (e.g., 1.28). In contrast, the Zacks Rank is a quantitative framework that focuses on earnings estimate revisions, presented as whole numbers from 1 to 5.

Historically, brokerage analysts have shown a tendency towards excessive optimism with their valuations. Their interest in promoting a stock often results in more favorable assessments than warranted by actual research findings.

The Zacks Rank, however, is adjusted based on real-time earnings estimate changes. Empirical studies have demonstrated a significant correlation between stock price shifts and earnings estimate revisions.

Moreover, the Zacks Rank methodology ensures equitable distribution of ratings across all stocks analyzed, preventing imbalances that might distort the data.

Another crucial distinction is timeliness. The ABR may not always reflect current information, as brokerage firms update their earnings estimates in response to changing business conditions. The Zacks Rank incorporates these estimates swiftly, making it a timely indicator of future stock price trends.

Evaluating Alibaba’s Investment Potential

Looking at Alibaba’s earnings estimate revisions, the Zacks Consensus Estimate for the current year has risen by 2.7% in the last month to reach $8.80.

This increase is supported by analysts’ mounting optimism regarding Alibaba’s earnings prospects, as reflected in their higher EPS estimates. Such consensus can be a strong signal for potential stock performance in the near future.

Reflecting this positive sentiment, Alibaba currently holds a Zacks Rank #1 (Strong Buy). For a complete list of today’s Zacks Rank #1 stocks, you can see here>>>>

Thus, the ABR rating aligning with the Buy recommendation for Alibaba may be beneficial for investors seeking guidance.

Zacks Research Highlights Stock with High Potential

Recently, Zacks Research pinpointed five stocks with the greatest likelihood of achieving +100% gains in the upcoming months. Of these, the Director of Research, Sheraz Mian, emphasizes one standout Stock expected to perform exceptionally well.

This top selection belongs to an innovative financial firm. With a rapidly expanding customer base (over 50 million) and a wide array of advanced solutions, this Stock is well-positioned for significant growth potential. While not all selections guarantee success, this one could potentially exceed past Zacks winners, such as Nano-X Imaging, which surged +129.6% within nine months.

Free: view Our Top Stock and 4 More Recommendations

For the latest insights from Zacks Investment Research, download the “7 Best Stocks for the Next 30 Days.” Click to access this complimentary report

Alibaba Group Holding Limited (BABA): Free Stock Analysis report

This article first appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.