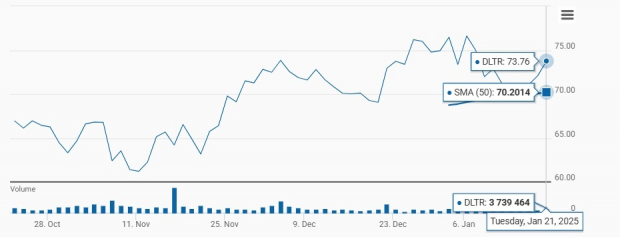

Dollar Tree, Inc. (DLTR) Shows Strong Momentum Above 50-Day Average

Dollar Tree, Inc. (DLTR) is currently trading above its 50-day simple moving average (SMA), indicating a positive trend for investors. The company is benefiting from growth in sales, increased customer traffic, and larger market share.

The 50-day SMA serves as a vital tool for traders and analysts, helping them identify significant support and resistance levels. It’s often seen as a critical indicator for determining the direction of a stock’s movement.

DLTR Showing Stronger Performance Compared to Peers

Image Source: Zacks Investment Research

Over the past three months, DLTR has gained an impressive 11.6%, outpacing the industry, which saw growth of just 3.8%. Additionally, Dollar Tree’s performance surpassed the broader Retail-Wholesale sector’s increase of 9.5% and the S&P 500’s rise of 4.7%, highlighting the company’s competitive advantage.

Dollar Tree’s Expansion Efforts and Strategy

Image Source: Zacks Investment Research

The company has made significant strides in upgrading its store portfolio. In Q3 of fiscal 2024, Dollar Tree opened 255 new stores, revamped four existing locations, and closed 49 underperforming ones. These changes are part of a broader strategy to refine its store formats.

Dollar Tree has also advanced its multi-price strategy, introducing $3, $4, and $5 frozen and refrigerated products, plus expanding its offerings across food, snacks, beverages, pet care, and personal care. This approach has proven effective, particularly in Dollar Tree and Combo Stores, bolstering the brand’s market position.

The switch to a multi-price 3.0 format continues to show promise. In the latest quarter, the company converted 720 stores, totaling nearly 2,300 locations. These stores now account for around 30% of Dollar Tree’s quarterly net sales and achieved a comparable store sales growth of 3.3%, with consumables driving a 6.6% increase. The company aims to transition another 300-400 stores to this format by fiscal year-end, which is predicted to boost sales and profitability.

Positive Financial Projections for Dollar Tree

Dollar Tree has updated its fiscal 2024 outlook following strong Q3 results. For the upcoming Q4, projected consolidated net sales are estimated to be between $8.1 billion and $8.3 billion, with expectations for comparable store sales growth in the low single digits across the Dollar Tree and Family Dollar segments.

For the entire fiscal year 2024, the company estimates consolidated net sales between $30.7 billion and $30.9 billion, slightly higher than prior expectations and above last year’s figure of $30.6 billion. Comparable sales growth for Q4 is expected at 1.8%, and for fiscal 2024 overall, it is projected to be 1.3%.

Challenges Facing DLTR Stock

Recent quarters have seen rising selling, general and administrative (SG&A) expenses at Dollar Tree, primarily due to increased operating costs. This uptick is linked to greater depreciation from store investments, a reliance on temporary labor for the multi-price rollout, higher utility bills, and the challenges of leveraging increased same-store sales.

The Family Dollar segment faces difficulties stemming from reduced spending among low-income consumers, resulting in lower demand for non-essential items. Many core customers are feeling financial pressure due to cuts in government SNAP benefits, which has shifted their focus toward necessary products. These broader economic conditions are affecting customer confidence and spending behavior.

Such factors introduce uncertainty, leading to a more reserved investment outlook for Dollar Tree. The company currently holds a Zacks Rank #3 (Hold), indicating a neutral position on the stock.

Alternative Stock Picks in the Sector

Investors may want to consider three better-ranked stocks: Deckers Outdoor (DECK), Abercrombie & Fitch Co. (ANF), and The Gap, Inc. (GAP).

Deckers, known for footwear and accessories, holds a Zacks Rank #1 (Strong Buy) and has experienced an average earnings surprise of 41.1% over the last four quarters. The Zacks consensus estimates suggest growth of 14.1% and 14.4% in fiscal 2024 sales and earnings, respectively, compared to the previous year’s figures.

Abercrombie, a casual apparel retailer, also has a Zacks Rank of 1, boasting an average trailing earnings surprise of 14.8%. The Zacks Consensus Estimate for ANF’s fiscal 2024 indicates increases of 15% and 69.3% in sales and earnings, respectively.

Gap focuses on apparel, accessories, and personal care products, currently maintaining a Zacks Rank #2 (Buy). The Zacks consensus projects growth of 0.8% in sales and 41.3% in earnings compared to the last year’s quarter, with a trailing earnings surprise of 101.2% on average.

Discover Stocks with High Growth Potential

Our research team has identified five stocks with significant potential for remarkable gains. Among these, Sheraz Mian, director of research, highlights one stock expected to reach impressive growth.

This particular stock belongs to an innovative financial firm with over 50 million customers. With a diverse range of cutting-edge solutions, it is poised for substantial growth. Past Zacks’ predictions, like Nano-X Imaging which surged by +129.6% in less than nine months, demonstrated the potential found within these selections.

Free: See Our Top Stock And 4 Runners Up

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

The Gap, Inc. (GAP) : Free Stock Analysis Report

Read the full article on Zacks.com.

The views expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.