Johnson & Johnson: Q4 Earnings Preview and Market Dynamics

Important Highlights

- The Zacks Consensus Estimate for JNJ’s Q4 sales is $22.5 billion, with earnings expected at $2.01 per share.

- Johnson & Johnson surpassed earnings expectations in each of the last four quarters, showcasing strong performance.

- Over the past year, JNJ stock fell by 9.5%, in contrast to the industry’s 5.4% decline.

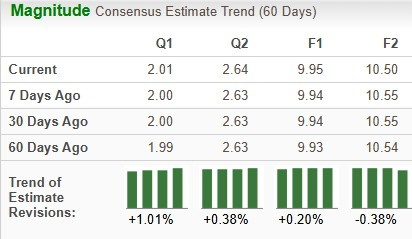

Johnson & Johnson (JNJ) is scheduled to announce its fourth-quarter and full-year earnings on January 22. For the fourth quarter, the Zacks Consensus Estimate stands at sales of $22.54 billion and earnings of $2.01 per share. Over the last 60 days, JNJ’s earnings forecast for 2024 improved from $9.93 to $9.95 per share, while 2025’s estimate dropped from $10.54 to $10.50 per share.

Check the latest EPS estimates and surprises on Zacks Earnings Calendar.

Shifts in JNJ’s Earnings Estimates

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

JNJ’s Earnings Surprise Track Record

Over the last four quarters, JNJ has consistently exceeded earnings expectations, achieving an average earnings surprise of 4.15%. In the most recent quarter, the company reported a notable 9.01% earnings surprise.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Current Stock Performance and Forecast

JNJ’s Earnings ESP is currently at +4.99%, with a Zacks Rank of #3 (Hold), indicating potential positive earnings surprises. Our model suggests that companies showing both a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 have solid chances of surpassing earnings estimates.

Factors Influencing JNJ’s Upcoming Results

Sales growth in JNJ’s Innovative Medicines segment is anticipated to be fueled by strong performances from key products such as Darzalex, Tremfya, and Erleada.

The expected sales figure for Darzalex is around $3.04 billion, with our estimates slightly higher at $3.06 billion. For Tremfya, estimates stand at $1.06 billion, with our prediction at $1.09 billion. Erleada’s sales are projected at $793.8 million by consensus, while our estimate is a bit higher at $805.0 million.

Other products, including Invega Sustenna, Uptravi, and Opsumit, are also likely to show sales growth. The recent uptake of new drugs like Carvykti and Tecvayli, among others, should positively impact revenue. Conversely, sales of Stelara faced challenges, particularly due to intensified competition from European biosimilars launched in July 2024.

Looking ahead, several biosimilar versions of Stelara are expected to launch in the U.S. in 2025, including Amgen’s Wezlana, which made its debut earlier this year. However, analysts do not foresee a significant impact on Stelara’s sales for Q4 2024.

For Stelara, the consensus estimate stands at $2.35 billion, while our projection is $2.21 billion. Likewise, sales of Imbruvica are likely to drop, attributed to increased competition, with estimates around $719 million against our projection of $710.1 million. Products like Xarelto are also expected to see sales declines due to generic and biosimilar competition.

The expected sales for JNJ’s Innovative Medicine unit is $14.28 billion, close to our estimate of $14.1 billion.

Conversely, the MedTech segment faced headwinds, especially in the Asia Pacific region, influenced by factors such as the volume-based procurement program and an anti-corruption campaign in China. New products and improved commercial strategies are anticipated to drive growth outside China.

For the MedTech segment, the consensus forecast is $8.28 billion, while our estimate is $8.23 billion. Ultimately, short-term performance is less critical for long-term investors; a broader analysis is needed to determine whether JNJ stock is a buy, hold, or sell opportunity.

JNJ Stock Performance Comparison

In the last year, JNJ’s stock has decreased by 9.5%, underperforming the broader industry, which declined by 5.4%. This trend also reflects a lack of performance relative to both the sector and the S&P 500 index.

J&J Stock: A Closer Look at Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Johnson & Johnson: Navigating Challenges with Growth Potential

Current Valuation Status

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation perspective, Johnson & Johnson (J&J) appears appealing. Its stock currently trades at a price/earnings ratio of 13.95 for forward earnings, notably lower than the industry average of 15.29 and its own historical mean of 16.02.

A key strength for J&J lies in its diversified business model. Following the split of its Consumer Health segment into a newly public company named Kenvue (KVUE), J&J now concentrates on two main sectors: Pharmaceuticals and MedTech.

Growth is evident in J&J’s Innovative Medicines segment, supported by a robust research and development pipeline. The company recently enhanced its MedTech offerings with acquisitions of Shockwave and V-Wave, as well as bolstering its Innovative Medicines pipeline with Ambrx, Proteologix, and NM26 bispecific antibody.

In January, J&J entered into a definitive agreement to acquire Intra-Cellular Therapies (ITCI) for approximately $14.6 billion, or $132.00 per share. This acquisition includes Caplyta, the only approved medication from Intra-Cellular Therapies for bipolar I and II depression and schizophrenia, which will significantly enrich J&J’s neuroscience portfolio. Additionally, J&J will gain access to several other candidates in the central nervous system area.

Despite these positive developments, J&J faces several hurdles. Slow sales within its MedTech sector, potential patent expiration of its blockbuster drug Stelara, and ongoing talc-related legal challenges have raised concerns.

Currently, J&J is dealing with over 62,000 lawsuits connected to its talc-based products, primarily targeting claims that contain asbestos linked to ovarian cancer in women.

Looking ahead, J&J’s outlook for 2025 seems promising. Growth in its Innovative Medicine segment is anticipated to come from key products such as Darzalex, Tremfya, and Erleada, along with newer drugs and indications. In the MedTech sector, J&J expects operational sales growth to fall within the upper range of its long-term guidance of 5-7%, fueled by new product launches and contributions from the Abiomed and Shockwave acquisitions.

Investment Strategy: Hold or Buy?

Regardless of how the fourth-quarter results unfold, current shareholders may find it wise to hold onto their investments. Improvements in the prospects of resolving talc lawsuits and J&J’s optimistic performance expectations for 2025 present a reassuring case. For investors with a long-term outlook, the current low stock price and valuation may present an appealing buying opportunity.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Explore High-Growth Potential

Five stocks have been identified by Zacks experts as the top picks, potentially offering gains of +100% or more in 2024. Previous recommendations have achieved remarkable returns of +143.0%, +175.9%, +498.3%, and +673.0%.

The majority of these stocks are currently off the radar of Wall Street, creating a unique opportunity to invest early.

Today, See These 5 Potential Home Runs >>

Johnson & Johnson (JNJ): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Intra-Cellular Therapies Inc. (ITCI): Free Stock Analysis Report

Kenvue Inc. (KVUE): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.