Medical Properties Trust Faces Critical Decisions as Risks Loom

Medical Properties Trust (NYSE: MPW) is attracting attention due to its high dividend yield of 8%. However, this comes with considerable risk as the real estate investment trust (REIT) encounters challenges with its tenants. The question now is: is Medical Properties Trust stock a good buy?

Challenges Ahead for Medical Properties Trust

Medical Properties Trust has been through several tough situations recently. Two of its largest tenants filed for Chapter 11 bankruptcy in the past few years, with the latest filing occurring in January 2025. This indicates that the company’s challenges are ongoing.

Where to invest $1,000 right now? Our analysts have identified the 10 best stocks available today. See the 10 stocks »

Image source: Getty Images.

The extent of the issues has prompted Medical Properties Trust to reduce its dividend twice: from $0.29 per share to $0.15 in 2023, then again to $0.08 in 2024. This means the dividend has dropped by over 70%. The stock has also lost more than 80% of its value in the past three years.

This stock is not suited for risk-averse investors. Although the worst may be behind, the company is still grappling with significant issues. If another tenant struggles, the hoped-for recovery could be delayed. Even with a positive outlook, meaningful performance advancements could take years.

While the high dividend yield is appealing, many dividend investors may find the associated risk too great. Selling or avoiding this stock may be the wise decision.

Reasons to Retain Medical Properties Trust

For those who have held onto Medical Properties Trust through these turbulent times, you now face a choice: sell to realize a loss for tax benefits, or hold as the company strives to reposition itself for the future. There are signs of potential recovery.

In 2024, the REIT reclaimed some properties from one of its bankrupt tenants and has begun leasing them to a new operator. The rental income will initially be lower but is expected to rise over the next few years, reaching about 95% of the previous levels. The early 2025 bankruptcy filing could also positively influence the company’s outlook, although the process is still ongoing.

If you believe Medical Properties Trust is at a turning point and are willing to accept potential capital losses for a longer duration, holding onto your shares may have merit. Given the significant price decline already experienced, the impact on your overall portfolio may be less significant now. However, income-focused investors must recognize that the stock’s dividend is now far diminished.

Outlook for New Buyers of Medical Properties Trust

Purchasing Medical Properties Trust hinges on a strong belief that the healthcare REIT is turning a corner. Alternatively, one might conclude that the situation can’t worsen. Justifying an investment in this financially shaky, dividend-reducing REIT requires optimism about its future performance compared to the recent past.

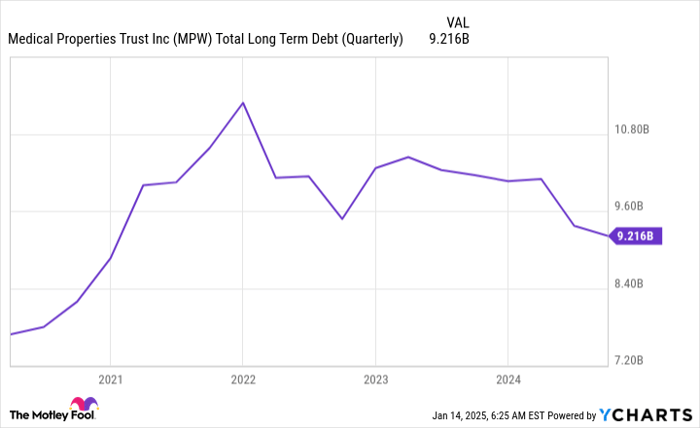

MPW Total Long Term Debt (Quarterly) data by YCharts

There are grounds for cautious optimism. Newly contracted tenants could lead to increased rental income in the coming years. The firm’s actions during the bankruptcy proceedings, together with other strategic moves, have improved its balance sheet. The question remains whether these advancements are enough to justify an investment.

For aggressive investors, the potential benefits may outweigh the risks, particularly with the high yield. Although dividends may take time to return to previous levels, improved business performance could eventually prompt dividend growth again. However, investors must proceed with caution: Medical Properties Trust is still a high-risk turnaround investment.

Most Investors Should Wait for More Evidence

In summary, conservative dividend investors drawn to the attractive yield of Medical Properties Trust may want to hold off on making a purchase. Risks remain, as the issues leading to two dividend cuts in recent years are still in play. Only bold investors willing to embrace high-risk turnaround stocks should consider holding or acquiring this stock.

Opportunity Awaits: Don’t Miss Out!

Have you ever felt you missed the chance to invest in top-performing stocks? Now might be your moment.

Our expert analysts occasionally name a “Double Down” stock, signaling a company that could see significant gains ahead. If you’re anxious that the opportunity has passed, this is the ideal time to invest before it’s too late. The numbers support this:

- Nvidia: an investment of $1,000 when we doubled down in 2009 would now be worth $346,349!*

- Apple: an investment of $1,000 when we doubled down in 2008 would now be valued at $43,229!*

- Netflix: an investment of $1,000 when we doubled down in 2004 would now be $454,283!*

Currently, we are issuing “Double Down” notifications for three outstanding companies, and this may be a rare opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

Reuben Gregg Brewer has no positions in any of the stocks mentioned. The Motley Fool has no positions in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed here are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.