Regency Centers Prepares for Q4 Earnings Reveal Amid Mixed Market Performance

Regency Centers Corporation (REG), based in Jacksonville, Florida, stands as a prominent real estate investment trust (REIT) specializing in shopping centers in suburban areas displaying strong demographics. With a market capitalization of $12.9 billion, the company’s portfolio features properties housing productive grocers, popular restaurants, service providers, and key retailers. The retail leader is set to disclose its fiscal fourth-quarter earnings for 2024 once markets close on Thursday, February 6.

Positive Forecasts Ahead of Earnings Announcement

Analysts predict REG will report a funds from operations (FFO) of $1.07 per share on a diluted basis, reflecting a 4.9% increase from the $1.02 per share recorded in the same quarter last year. Notably, the company has either met or exceeded Wall Street’s FFO estimates in its previous four quarterly reports.

For the entire year, expectations remain optimistic, with forecasts suggesting REG will record an FFO of $4.28, marking a 3.1% rise from the $4.15 in fiscal 2023. Looking ahead, FFO is anticipated to further climb by 4.9% year over year to reach $4.49 in fiscal 2025.

Stock Performance and Market Challenges

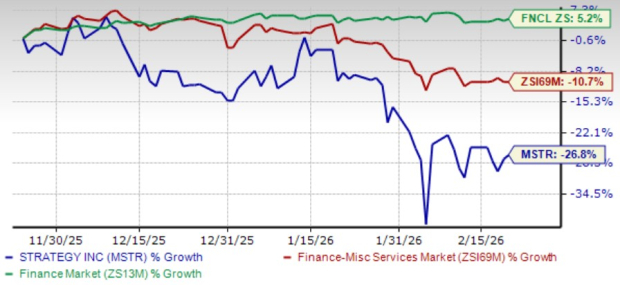

Over the past 52 weeks, REG stock has lagged behind the S&P 500, which gained 26.5%, with REG shares rising only 14%. However, it did surpass the Real Estate Select Sector SPDR Fund (XLRE), which saw a 6.5% increase within the same period. The REIT’s underperformance is largely attributed to varying market conditions and elevated interest rates, which have shaken investor confidence.

Recent Financial Highlights and Analyst Sentiment

On October 28, REG shares rose by 1% following the release of its Q3 results. The firm reported revenue of $360.3 million, surpassing Wall Street’s expectations of $355.2 million. Additionally, its FFO of $1.07 exceeded analyst projections of $1.04, with REG estimating full-year FFO to be between $4.27 and $4.29.

Surveying the analysts, the consensus stance on REG stock is strongly positive. Out of 17 analysts, 11 recommend a “Strong Buy,” while two suggest a “Moderate Buy,” and four advocate for a “Hold.” The current average analyst price target stands at $79.76, signifying a potential upside of 12% from current levels.

On the date of publication,

Neha Panjwani

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.