Note: The following is an excerpt from this week’s Earnings Trends report. To access the full report with detailed historical actuals and future estimates, please click here>>>

Main Takeaways

- As of Wednesday, November 6th, 399 S&P 500 companies that have reported Q3 earnings show an increase of +6.9% in profits and a +5.2% rise in revenues, with 73.9% surpassing EPS estimates and 61.4% exceeding revenue expectations.

- Looking ahead, earnings growth is predicted to pick up speed, with double-digit growth expected in three of the next four quarters.

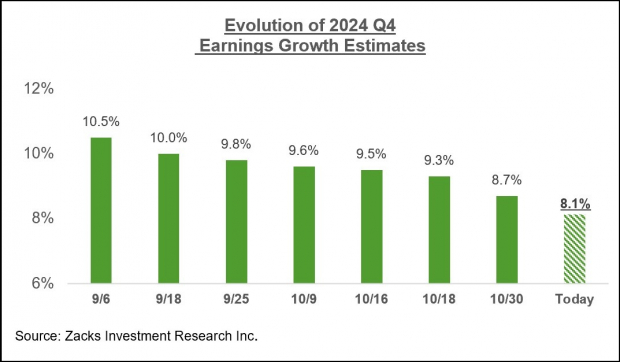

- In Q4 of 2024, total S&P 500 earnings are forecasted to increase by +8.1% year-over-year, supported by a +4.9% rise in revenues. Without the negative impact from the Energy sector, Q4 earnings for the rest of the index would increase by +10.0%.

- Earnings estimates for Q4 2024 have decreased since the quarter began, dropping from +9.8% at the start of October to +8.1%. However, this reduction is less severe than seen in Q3 and recent periods.

Magnificent 7: A Source of Sustainable Earnings Growth

Nvidia (NVDA), the sole company in the Magnificent 7 group yet to report Q3 results, remains a key player in the artificial intelligence (AI) sector. Scheduled to release its earnings on November 20th, Nvidia is expected to announce an impressive +81.9% increase in earnings and +81.1% rise in revenues compared to the same time last year.

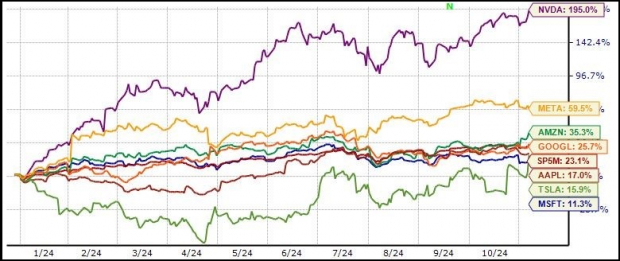

Nvidia’s stock has surged over +190% this year, greatly outperforming both the Magnificent 7 group and the overall tech market, as shown in the accompanying chart.

Image Source: Zacks Investment Research

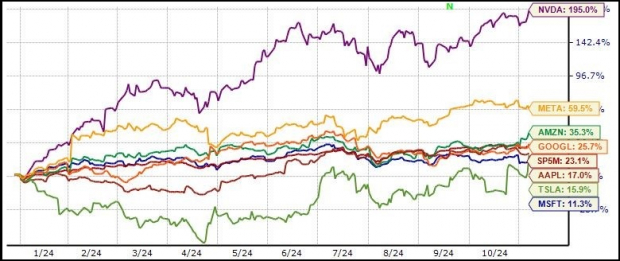

Despite current challenges faced by some Magnificent 7 companies, there’s no denying their robust profitability growth. Together, these seven firms are projected to generate $126.2 billion in Q3 earnings on $492.5 billion in revenues, signifying a year-over-year earnings growth of +30.5% and a revenue increase of +14.9%.

Image Source: Zacks Investment Research

The Magnificent 7 are set to contribute 23.1% of all S&P 500 earnings in Q3. Without their significant earnings boost, the remaining S&P 500 index would show only a +1.1% increase.

The Overview of Earnings

Considering Q3 as a whole, the combined actual results and estimates for remaining companies now predict total S&P 500 earnings to rise by +6.7% year-over-year, with revenues also increasing by +5.4%.

Excluding the Energy sector’s -24.2% decline, the overall Q3 earnings growth rate would improve to +9.1%. Additionally, without the significant contributions from the Tech sector, quarterly earnings would only grow by +1.8%, despite a +19.4% increase in earnings from the Tech sector.

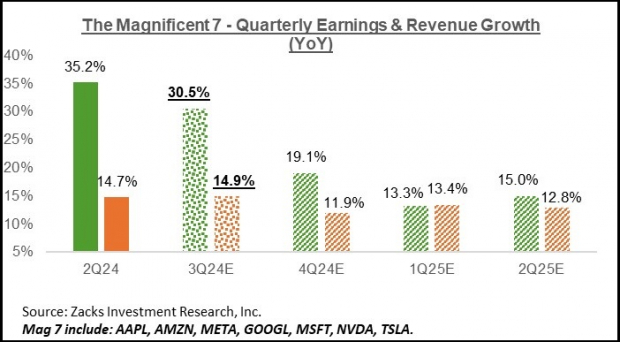

Looking ahead, the earnings trend is expected to strengthen from next quarter onward, as depicted in the chart below.

Image Source: Zacks Investment Research

For 2024 Q4, total S&P 500 earnings are projected to rise by +8.1% alongside a +4.9% revenue increase, with a +10.0% increase anticipated if not for issues in the Energy sector.

Although the estimates for the quarter have started to decline, this drop is milder compared to what was observed in Q3. The chart below illustrates the recent evolution of Q4 estimates.

Image Source: Zacks Investment Research

Additional details are explored in the annual earnings picture chart below.

Image Source: Zacks Investment Research

It’s important to note that this year’s earnings growth of +7.9% alongside only a +1.9% increase in revenues is significantly impacted by weaknesses in the Finance sector. When excluding Finance, the earnings growth adjusts to +7.1%, while revenue growth rises to +4.2%. Therefore, nearly half of this year’s earnings growth is driven by revenue growth, with margin increases accounting for the remaining gains.

Zacks Identifies a Leading Semiconductor Stock

This new standout semiconductor stock is only 1/9,000th the size of NVIDIA, which has soared over +800% since our recommendation. While NVIDIA remains a strong contender, our latest top chip stock has considerable growth potential.

With solid earnings growth and a widening customer base, it’s well-positioned to capitalize on the rising demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is anticipated to surge from $452 billion in 2021 to $803 billion by 2028.

Curious about this stock? Discover it for free now >>

For the latest stock recommendations from Zacks Investment Research, you can download “5 Stocks Set to Double.” Click here for this free report.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.