“`html

Vistra Stock Sets Records Among 2024 Market Winners

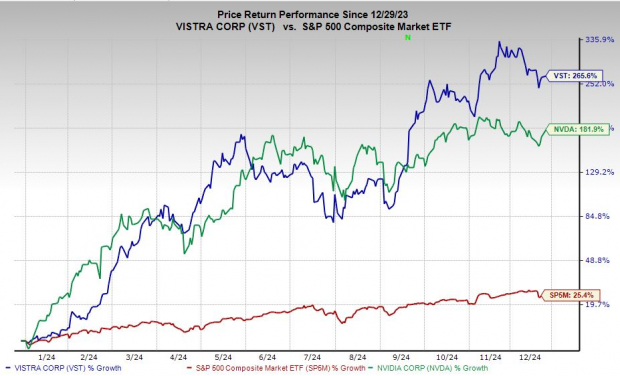

As artificial intelligence dominated discussions on Wall Street in 2024, nuclear and energy transition leader Vistra (VST) surged past Nvidia and virtually all other S&P 500 stocks, except for one.

Vistra’s growth has been impressive as both customers and investors are drawn to its competitive edge. With substantial investments in energy transition, the company is positioned well as major tech firms like Amazon and Meta invest heavily in nuclear energy as part of the push towards AI development.

Despite a 15% pullback since mid-November, VST stock is maintaining support near its 50-day moving average.

Reasons Behind Wall Street’s Enthusiasm for Vistra

Being the largest competitive power generator in the U.S., Vistra’s diversified portfolio is impressive, encompassing nuclear, solar, battery storage, and natural gas. The company boasts the second-largest competitive nuclear fleet and energy storage capacity in the nation.

With nearly 5 million residential, commercial, and industrial customers in 20 states, Vistra operates in all major competitive wholesale markets.

Operating in such a crucial sector, Vistra is meeting the energy demands of tech companies and other industries that prioritize nuclear and non-fossil fuel energy solutions.

Image Source: Zacks Investment Research

In March, Vistra acquired Energy Harbor, enhancing its zero-carbon generation capabilities by adding a 4,000-megawatt nuclear generation fleet and retail operations.

This strategic acquisition positioned Vistra among leading integrated zero-carbon electricity companies.

Vistra’s diverse portfolio also includes natural gas, which is expected to play a key role in the U.S. energy landscape for decades, especially as coal plants close down.

The company noted that the Inflation Reduction Act provides significant opportunities for its renewable and energy storage initiatives, reinforced by nuclear production tax credits.

Vistra is also exploring collaborations with top tech companies. During its Q3 earnings call, management disclosed ongoing discussions with two major firms about building new gas plants to support their data center projects.

Stacey Dore, Vistra’s chief strategy and sustainability officer, indicated potential for co-location deals at multiple sites, coupled with plans for new generation facilities at nuclear sites.

Image Source: Zacks Investment Research

Wall Street analysts, including those from Goldman Sachs, consider the energy transition a fundamental component of the U.S. economy for the latter part of this decade and beyond. With a growing demand for nuclear energy driven by AI, major corporations such as Amazon, Alphabet, Microsoft, and Meta have all announced significant nuclear energy investments in 2024.

Furthermore, the U.S. government is increasing its backing for nuclear energy as it aims to triple its nuclear capacity by 2050, facilitating a gradual shift away from fossil fuels.

According to the International Energy Agency, $2 trillion was invested in clean energy technologies and infrastructure in 2024, including wind, solar, energy storage, and nuclear power.

Is It Time to Invest in One of 2024’s Top Stocks?

Vistra’s stock has skyrocketed 265% in 2024, outpacing Nvidia’s 185% increase and other significant players in the nuclear and energy transition sectors, such as Constellation Energy, which rose 98%.

“`

Vistra Corp. Soars Ahead: A Bright Future in Energy Transition

Strong Performance Amid Market Challenges

Vistra Corp. (VST) has shown impressive resilience, gaining 25% over the last three months. This achievement has allowed it to surpass rivals like Nvidia, Constellation Energy, and the S&P 500.

Over the past three years, Vistra’s stock surged 540%, greatly outperforming its Utilities sector average of only 1% and the S&P 500’s 25% growth. This stellar performance has far exceeded Constellation’s 330% and Nvidia’s 370% increases during the same period.

Image Source: Zacks Investment Research

Despite this remarkable track record, Vistra currently trades 15% lower than its peak in November and falls 19% short of Zacks’ average price target. The stock is working to stabilize around its 50-day moving average, having seen buying interest around its October highs.

The recent market correction has allowed Vistra to adjust from overbought conditions. Additionally, the company’s Price/Earnings-to-Growth (PEG) Ratio suggests a 33% value compared to other companies in the Zacks Utilities sector.

Why Wall Street is Bullish on Vistra for 2025

Vistra has captured the attention of Wall Street, where 11 of 12 brokerage recommendations from Zacks endorse it as a “Strong Buy.” Furthermore, the company not only pays dividends but also announced an additional $1 billion in stock repurchases this past November.

Investing in Vistra provides exposure to the ongoing energy transition and the revival of nuclear energy. These trends are bolstered by support from major tech companies like Microsoft and commitments from the U.S. government.

Five Stocks Positioned for Doubling in 2024

Zacks Investment Research has identified five stocks handpicked as having the potential to gain over 100% in 2024. Previous recommendations have seen gains of +143.0%, +175.9%, +498.3%, and +673.0%.

These stocks are mostly off Wall Street’s radar, presenting a unique opportunity for early investors.

Discover these five potential winners now by clicking here to access the free report.

Constellation Energy Corporation (CEG): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Vistra Corp. (VST): Free Stock Analysis Report

GE Vernova Inc. (GEV): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.