ANSYS Inc. Prepares for Q3 2024 Earnings Report: Expectations and Insights

ANSYS Inc (ANSS) will announce its earnings for the third quarter of 2024 on Nov. 6, after markets close.

Stay informed with quarterly updates: Check out Zacks Earnings Calendar.

What Wall Street Expects

The Zacks Consensus Estimate anticipates earnings per share (EPS) of $1.88, steady compared to the last two months. This represents a significant growth of 33.33% from the EPS reported in the same quarter last year.

Revenue expectations stand at $531 million, showcasing a 15.75% increase from the previous year.

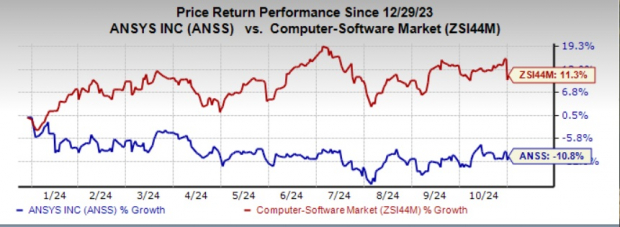

Over the past four quarters, ANSS has surpassed the Zacks Consensus Estimate three times, missing once. On average, the company has delivered an earnings surprise of 4.8%. However, in the year-to-date period, ANSS shares have declined by 10.8%, contrasting with an 11.3% rise in the sub-industry and a 20.5% increase for the S&P 500 Index.

Image Source: Zacks Investment Research

Key Growth Drivers

Strong sales in simulation solutions across major sectors—such as aerospace and defense (A&D), high tech, automotive, industrial equipment, and energy—are expected to positively impact ANSS’s revenue for the quarter.

The A&D industry remains robust, driven by advancements in the space sector and ongoing digital transformation, favorably influencing the company’s software services. In the automotive realm, the growing interest in electric vehicles and advanced driver-assistance systems should further contribute to revenue increases. Additionally, developments in artificial intelligence (AI) and machine learning are enriching simulation software capabilities, thereby creating new opportunities for ANSS. The high-tech sector, bolstered by AI innovations, adds to this momentum.

However, geopolitical tensions, unfavorable foreign exchange rates, and broader economic challenges could hinder ANSS’s performance.

In light of its acquisition by Synopsys, announced in January 2024, ANSS discontinued providing financial guidance. Nevertheless, the company anticipates varying annual contract value (ACV) and revenue growth rates throughout 2024, projecting double-digit ACV and revenue growth in the latter half of the year.

ANSYS, Inc. Price and EPS Surprise

ANSYS, Inc. price-eps-surprise | ANSYS, Inc. Quote

Recent Collaborations

In September, ANSYS, TSMC, and Microsoft achieved significant advancements by testing a solution that enhances the simulation and analysis of silicon Photonic Integrated Circuits (PICs). This collaboration has resulted in a 10X speed improvement in ANSYS’ Lumerical FDTD photonic simulations, utilizing Microsoft Azure’s NC A100v4-series virtual machines powered by NVIDIA technology.

Additionally, ANSYS has bolstered its long-lasting partnership with TSMC, focusing on utilizing AI to revolutionize multiphysics solutions that contribute to semiconductor design efficiencies.

Analyzing the Data

According to our evaluation model, the likelihood of ANSYS posting an earnings surprise remains unclear this quarter. A positive Earnings Surprise Prediction (ESP) paired with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically boosts the chances of reporting higher earnings. Unfortunately, ANSS does not fit this mold.

Earnings ESP: ANSS in this quarter has an Earnings ESP of 0.00%. Discover the best stocks to trade using our Earnings ESP Filter.

Zacks Rank: Currently, ANSS holds a Zacks Rank of #3. You can explore today’s full list of Zacks #1 Rank stocks here.

Stocks to Watch for Earnings Surprises

Consider these stocks that combine key factors likely to lead to earnings beats this season:

Shopify (SHOP) shows an Earnings ESP of +5.78% with a Zacks Rank of #1. The company will present its third-quarter 2024 results on Nov. 12, with expected earnings of 27 cents per share and revenues of $2.1 billion. Over the last year, Shopify shares surged by 70.2%.

BlackSky Technology Inc. (BKSY) holds an impressive Earnings ESP of +29.51% and a Zacks Rank of #2. BKSY is set to report on Nov. 7, with anticipated earnings of a loss of 61 cents and revenues of $26.9 million. In the past year, BKSY shares have decreased by 25%.

Yelp Inc. (YELP) currently has an Earnings ESP of +15.48% and a Zacks Rank of #1. YELP will also report quarterly results on Nov. 7, with earnings expected at 40 cents per share and revenues of $362.1 million. Over the last year, YELP shares fell by 18.2%.

Looking Ahead

From a pool of thousands, Zacks experts have identified five stocks poised for significant growth. Among them, Director of Research Sheraz Mian has hand-selected one to potentially double in value, targeting younger consumer demographics with nearly $1 billion in revenue last quarter. With a recent dip in price, now could be the right moment to invest. While not every pick is successful, this company’s potential exceeds performances of prior Zacks stocks, such as Nano-X Imaging, which rose by an impressive 129.6% in just over nine months.

Free: Access Our Top Stock And 4 Additional Recommendations

For the latest investment insights from Zacks Investment Research, download 5 Stocks Set to Double. Click for your free report.

Yelp Inc. (YELP): Free Stock Analysis Report

ANSYS, Inc. (ANSS): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

BlackSky Technology Inc. (BKSY): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.