Abbott Laboratories Anticipates Earnings Growth in April 2025

Abbott Laboratories (NYSE:ABT) will announce its earnings on Wednesday, April 16, 2025. Analysts predict the company will report earnings of $1.07 per share against sales of $10.41 billion for the first quarter. This forecast indicates an increase from the previous year’s quarter, which featured earnings of $0.98 per share and sales of $9.96 billion. A significant contributor to this expected growth is Abbott’s diabetes product, Freestyle Libre.

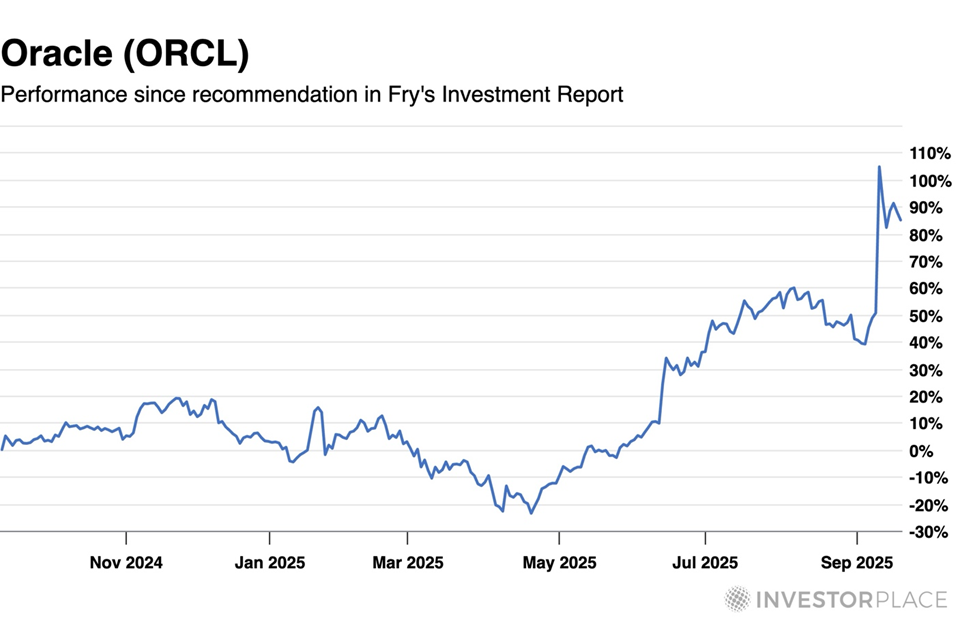

Currently, Abbott boasts a market capitalization of $220 billion, alongside revenue of $42 billion and operating profits of $6.8 billion over the last twelve months, resulting in a net income of $13 billion. The reaction of ABT Stock to the upcoming earnings announcement will hinge on how these figures and future outlook meet investor expectations. Notably, historical data reveals that ABT has experienced a drop in share price one day after earnings 60% of the time over the past five years, with a median decline of 2.4% and a maximum dip of -6.5%.

This historical trend provides useful insights for event-driven traders. They may choose to adjust their positions ahead of the announcement based on these odds or analyze the relationship between immediate and medium-term returns to consider entering a trade the day following the earnings release. For those seeking lower volatility compared to individual stocks, the Trefis High-Quality portfolio could be an alternative, as it has outperformed the S&P 500, yielding returns over 91% since inception.

Explore the earnings reaction history of all stocks

Image by Tatiana from Pixabay

Abbott Laboratories: Historical Trends in Post-Earnings Returns

Analysis of one-day (1D) post-earnings returns reveals several key points:

- Out of 20 earnings reports in the past five years, there were 8 positive and 12 negative 1D returns, indicating positive outcomes occurred approximately 40% of the time.

- However, limiting the data to the last three years yields a positive return rate of 50%.

- The median gain from the 8 positive returns stands at 3.5%, while the median loss from the 12 negative ones is -2.4%.

Further insights regarding 5-day (5D) and 21-day (21D) post-earnings returns are presented in the accompanying table.

ABT observed 1D, 5D, and 21D returns post earnings

Evaluating Correlation Between Historical Returns

Understanding the correlation between short-term and medium-term returns post-earnings can inform trading strategies. For example, identifying periods where 1D and 5D returns show high correlation allows traders to position “long” for the next five days if the 1D post-earnings return is positive. Below is data indicating correlations based on 5-year and 3-year (recent) history. The correlation 1D_5D illustrates the relationship between 1D post-earnings returns and following 5-day returns.

ABT Correlation Between 1D, 5D and 21D Historical Returns

Discover more about Trefis RV strategy, which has outperformed its all-cap stocks benchmark. For investors seeking the potential for gains with a more stable investment than Abbott Laboratories, consider the High Quality portfolio, which has also performed well, outperforming the S&P 500 with returns exceeding 91% since launch.

Invest with Trefis Market-Beating Portfolios

Discover all Trefis Price Estimates

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.