Berkshire Hathaway Set to Report Q3 Earnings Amid Market Upswing

Omaha, Nebraska’s Berkshire Hathaway Inc. (BRK.B) is a major player in multiple sectors including insurance, utilities, freight transport, and retail. With a robust market cap of $1 trillion, its influence stretches across the Americas, Indo-Pacific, Europe, and beyond. The company will unveil its Q3 earnings on Friday, Nov. 1.

Analysts Predict Earnings Dip for Q3

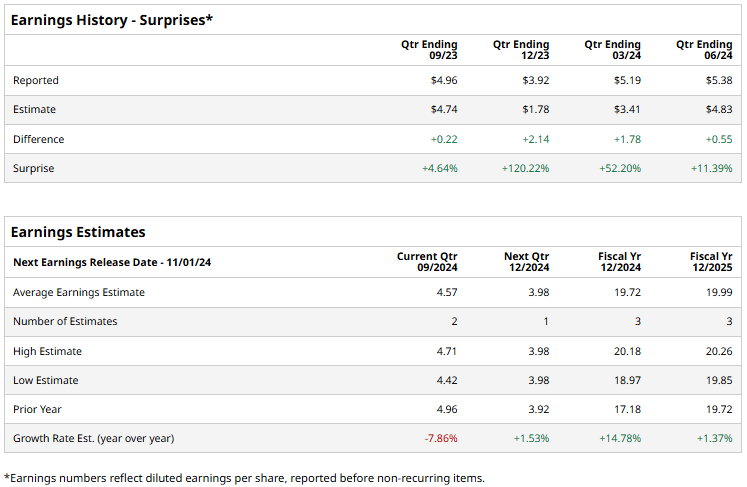

Ahead of the earnings report, analysts estimate a profit of $4.57 per share, which represents a 7.9% decrease from $4.96 per share in the same quarter last year. Notably, Berkshire has beaten Wall Street’s adjusted EPS expectations for four consecutive quarters. Its adjusted EPS for the last reported quarter rose 17.9% year-over-year to $5.38, exceeding consensus estimates by 11.4%.

Future Projections: Growth on the Horizon

Looking ahead to fiscal year 2024, analysts forecast an adjusted EPS of $19.72, up 14.8% from $17.18 in FY 2023. Moreover, for FY 2025, the adjusted EPS is projected to increase slightly by 1.4% to $19.99.

Solid YTD Performance Outshines Major Indices

Berkshire Hathaway’s stock has surged by 30.6% year-to-date, outperforming the S&P 500 Index’s 22.5% gain and the Financial Select Sector SPDR Fund’s (XLF) 26.3% increase during the same period.

Market Reaction Following Q2 Earnings Release

Following its Q2 earnings announcement on Aug. 3, Berkshire’s shares fell by 3.4% due to a significant net income drop. The company experienced a staggering 27.8% decline in investment gains, totaling $23.9 billion, which contributed to a 15.5% decrease in net income to shareholders, now at $30.3 billion. In contrast, revenue grew by 1.2% to $93.7 billion, aided by increases in insurance and other revenues. Additionally, total costs and expenses receded by 1.3%, amounting to $79.6 billion.

Despite this initial setback, Berkshire’s adjusted EPS for non-recurring items saw significant growth. After the drop, BRK.B rebounded by 2% in the following trading session and maintained positive momentum for three additional sessions.

Moderate Buy Rating from Analysts

Analysts hold a moderately bullish outlook on BRK.B stock with an overall “Moderate Buy” rating. Among six analysts, two suggest a “Strong Buy”, while four recommend a “Hold.” The average price target of $471.50 indicates a potential upside of 1.2% from current levels.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.