Expedia Set for Q1 Earnings Release Amid Strong Travel Demand

Expedia (NASDAQ: EXPE) is set to announce its fiscal first-quarter earnings on Thursday, May 8, 2025. Analysts anticipate earnings of 40 cents per share and $3.01 billion in revenue. This forecast reflects a remarkable 90% growth in adjusted earnings year-over-year and a 4% rise in revenue compared to the previous year’s results of 21 cents per share and $2.89 billion in revenue. Historically, EXPE stock has often outperformed after earnings releases, rising 56% of the time with a median one-day increase of 5.5% and a peak gain of 19%.

The company is leveraging strong global travel demand and improved profit margins in both its B2B and B2C segments. Investments in AI and the “One Key” loyalty program are enhancing customer retention, while share buybacks reinforce shareholder value. With a market capitalization of $21 billion, Expedia has reported $14 billion in revenue over the past twelve months, with an operating profit of $1.3 billion and net income of $1.2 billion.

Exploring Historical Earnings Trends

For traders focusing on earnings events, historical trends can provide valuable insights. Those looking for less volatility may consider alternatives such as the Trefis High-Quality Portfolio, which has outperformed the S&P 500 with returns exceeding 91% since its inception.

Expedia’s Odds of Positive Post-Earnings Returns

Examining one-day (1D) post-earnings returns reveals the following:

- Over the last five years, there have been 18 earnings observations, with 10 positive and 8 negative returns recorded. This indicates that positive returns occurred approximately 56% of the time.

- If we narrow the focus to the last three years, the positive return percentage rises to 70%.

- The median increase for positive returns is 5.5%, while the median decrease for negative returns is -11%.

Further statistics regarding observed returns over 5-day (5D) and 21-day (21D) periods following earnings are summarized in the table below.

Correlation Between Historical Returns

Understanding correlations between short-term and medium-term returns post-earnings can present a less risky strategy. Traders might look to enter “long” positions for the following five days if the one-day post-earnings return is favorable. The following data illustrates the correlation trends based on recent 5-year and 3-year histories.

EXPE Correlation Between 1D, 5D, and 21D Historical Returns

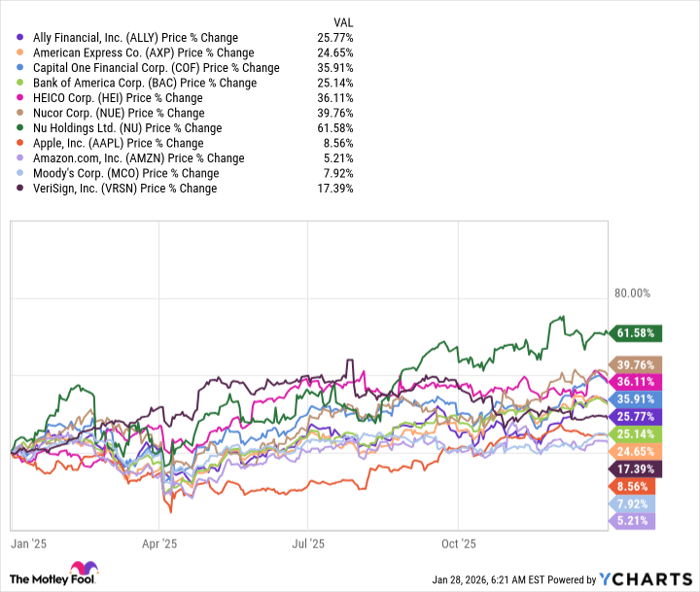

Influence of Peer Earnings on Expedia

Peer performance often impacts how stocks react post-earnings. Sometimes, stock movements begin before the earnings reports are made public. Below is a comparison of Expedia’s post-earnings performance against peers that reported earnings just before it.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.