Genuine Parts Company to Report Q4 Earnings Amidst Stock Decline

Genuine Parts Company (GPC), headquartered in Atlanta, Georgia, stands as a prominent global supplier of automotive and industrial replacement parts. The company boasts a market capitalization of $16.7 billion and operates over 10,700 locations across 17 countries, employing more than 60,000 people internationally. GPC is scheduled to release its fourth-quarter earnings report on Tuesday, April 22.

Anticipated Earnings Results

As the earnings date approaches, analysts predict GPC will announce a non-GAAP profit of $1.66 per share. This figure reflects a significant decrease of 25.2% compared to the $2.22 per share reported in the same quarter last year. In the preceding four quarters, GPC’s earnings performance has been inconsistent, with the company surpassing Wall Street estimates twice while falling short on two occasions.

Future Projections

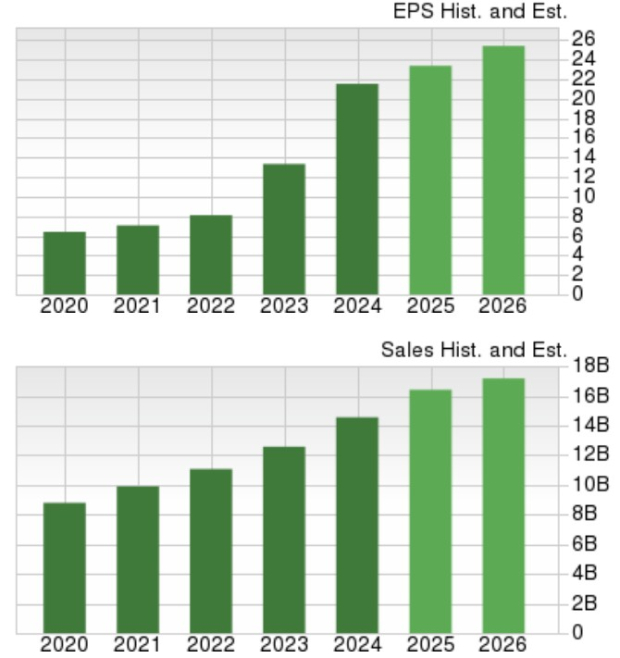

For fiscal year 2025, adjusted earnings per share (EPS) is expected to decline by 3.3%, dropping to $7.89 from $8.16 in fiscal year 2024. However, a rebound is on the horizon, with analysts forecasting a 12.2% growth in EPS to reach $8.85 in 2026.

Stock Performance Overview

Over the past year, Genuine Parts stock has declined by 22.5%, significantly underperforming against the S&P 500 Index, which has risen by 3.6%. Additionally, the Consumer Discretionary Select Sector SPDR Fund (XLY) has seen a return of 6.2% during the same period.

Analyst Ratings and Trends

Adding to the company’s struggles, GPC shares fell more than 1% after The Goldman Sachs Group, Inc. (GS) downgraded its rating from “Neutral” to “Sell.” This decision stems from concerns regarding the company’s short-term growth prospects and anticipated margin pressures. Goldman Sachs has established a price target of $114 for GPC, indicating a pessimistic outlook on the stock’s valuation and future performance.

Currently, GPC carries a consensus “Hold” rating, a decrease from a “Moderate Buy” rating just a month before. Among the 11 analysts tracking GPC, three recommend a “Strong Buy,” seven suggest a “Hold,” and one advises a “Strong Sell.”

The average price target for the stock stands at $129.33, suggesting a 9% upside from the present price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.