The Hartford Set to Release Q1 Earnings Amid Positive Forecasts

Connecticut-based The Hartford Insurance Group, Inc. (HIG), valued at $33.2 billion by market cap, offers insurance and financial services to individuals and businesses across the United States, the United Kingdom, and beyond.

Upcoming Q1 Results and Analyst Expectations

The insurance industry leader will report its first-quarter results after the market closes on Thursday, April 24. Analysts anticipate a non-GAAP profit of $2.24 per share, reflecting a 4.3% decrease compared to last year’s $2.34 per share. While the company has missed analysts’ bottom-line estimates once in the past four quarters, it has exceeded expectations three times. In Q4 2024, HIG reported a non-GAAP EPS of $2.94, outpacing consensus estimates by 10.1%.

Full Year and Future Earnings Projections

Looking ahead, analysts project that HIG will achieve a non-GAAP EPS of $11.06 for the full fiscal year 2025, marking a 7.4% increase from $10.30 in fiscal 2024. Additionally, earnings are expected to rise significantly in fiscal 2026, reaching $12.65 per share—a 14.4% year-over-year surge.

Stock Performance and Market Comparison

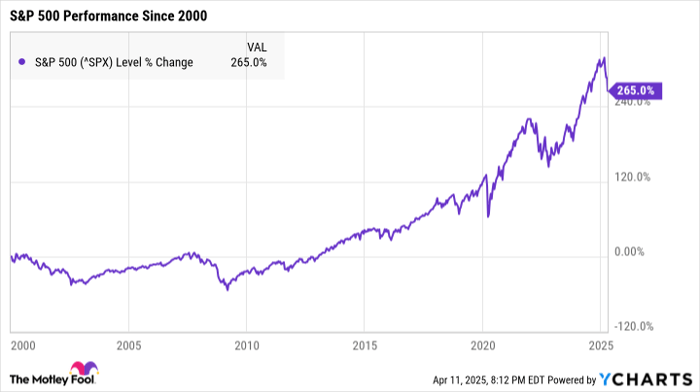

Over the past 52 weeks, Hartford Insurance’s stock has surged approximately 15.6%, outperforming the S&P 500 Index, which saw a modest 2.1% increase, and the Financial Select Sector SPDR Fund (XLF), which gained 12.3% during the same period.

Recent Quarterly Highlights

After reporting mixed Q4 results on January 30, HIG’s stock price dipped by 2.4%. The company’s topline showed promising growth, with total revenues rising 7.5% year-over-year to $6.9 billion, slightly exceeding analysts’ expectations. Conversely, non-GAAP earnings fell 7.5% year-over-year, totaling $865 million.

In positive news, Hartford Insurance repurchased $1.5 billion in shares during fiscal 2024, highlighting its commitment to returning value to shareholders. The firm also saw its non-GAAP return on equity (ROE) increase to 16.7%, up from 15.8% in fiscal 2023.

Analyst Outlook and Rating

The overall consensus on HIG stock is optimistic, with a “Moderate Buy” rating among analysts. Out of 21 analysts covering the stock, nine have issued a “Strong Buy” rating, two recommend “Moderate Buy,” and 11 suggest a “Hold.” The mean price target stands at $129.53, indicating a 12.8% upside from current pricing.

On the date of publication, Aditya Sarawgi had no positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.