Home Depot to Launch Q3 Earnings Season Amid Challenging Market Conditions

Home Depot HD is set to start the Q3 earnings season for traditional retailers this week. The company will release its results before the market opens on Tuesday, November 12th. Following closely, Lowe’s LOW will report its earnings on Tuesday, November 19th.

Lowe’s Outpaces Home Depot in Stock Performance

This year, Lowe’s shares have shown stronger performance than Home Depot, increasing by 21.6% compared to Home Depot’s 16.8%. However, both companies are behind the Zacks Construction sector, which has grown by 26.4%, and the S&P 500 index, up by 25.7% as illustrated in the chart below.

Image Source: Zacks Investment Research

Challenges Persist in the Retail Environment

The operating environment for both Home Depot and Lowe’s remains tough. The current interest rate climate is not favorable, despite efforts from the U.S. Federal Reserve to ease monetary policy. Recent strength in treasury yields likely points to market responses related to the upcoming U.S. elections and anticipated pro-growth policies from the new administration.

While the Fed is expected to continue easing, as confirmed by the Fed Chair’s recent press conference, treasury yields may eventually decline. However, the yield curve’s shorter end will reflect the Fed’s easing while the longer end may remain resistant, indicating expectations for stronger economic growth.

For Home Depot and Lowe’s, the implications of this interest rate discussion suggest that mortgage rates may not drop as significantly or quickly as typical during a Fed easing cycle. Consequently, the trend in existing home sales is unlikely to improve significantly in the short run, although a positive medium- to long-term outlook is still anticipated due to economic and demographic trends.

Home Depot’s Q3 Earnings Forecast

No significant surprises are expected in Home Depot’s Q3 results. It is projected that the company’s earnings will decrease by 5% from the previous year, despite a 4.1% rise in revenues. Estimates have declined since three months ago following management’s guidance on August 13th, but have slightly improved in recent days.

Retail Sector Earnings Overview

Regarding the Retail sector’s 2024 Q3 earnings season scorecard, results from 23 out of 34 S&P 500 retailers have come in. Unique to Zacks, the retail space is treated as a standalone economic sector, distinct from its placement in Consumer Staples and Consumer Discretionary sectors under Standard & Poor’s classifications.

The Zacks Retail sector encompasses not just Home Depot, Lowe’s, and other traditional retailers but also includes online vendors like Amazon AMZN and various restaurant businesses. To date, the 23 Zacks Retail companies that have shared Q3 results primarily come from the e-commerce and restaurant industries.

Performance Metrics for Q3 Earnings

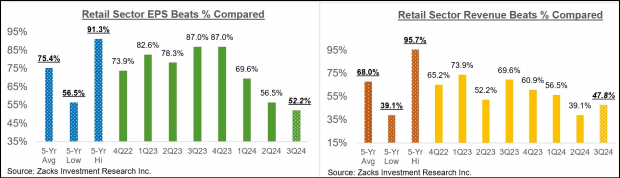

Total Q3 earnings for these 23 retailers have increased by 17.3% year-over-year, with revenues climbing by 6.3%. Approximately 52.2% of these companies surpassed EPS estimates, while 47.8% exceeded revenue expectations.

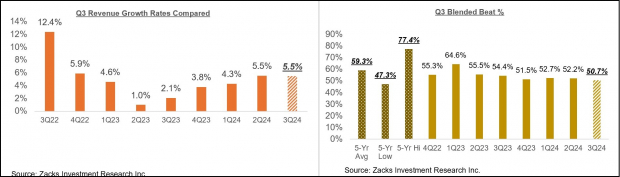

In the comparison charts below, the percentages of earnings beats in Q3 are placed in a historical framework.

Image Source: Zacks Investment Research

As shown, the online and restaurant sectors have faced challenges in surpassing EPS and revenue estimates this quarter. The percentage of Q3 EPS beats among these businesses marks a new low over the past five years, while the revenue beats percentage is only slightly above its 20-quarter low and significantly lower than the average.

The Impact of Amazon’s Performance

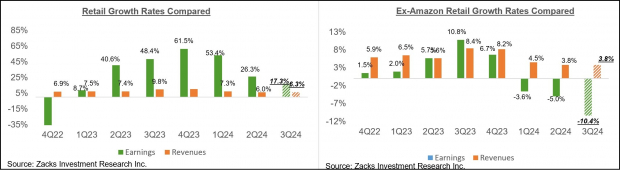

The elevated earnings rate observed can be largely attributed to Amazon. Its Q3 earnings surged by 71.6% on an 11% increase in revenues, successfully beating both EPS and revenue expectations.

Over recent years, the lines between the online and brick-and-mortar retail sectors have blurred. Amazon has expanded into brick-and-mortar operations with purchases like Whole Foods, while Walmart has evolved into a significant online retailer. Walmart’s upcoming earnings report is anticipated, as the retailer has continued to strengthen its digital advertising presence, boosted by trends initiated during the Covid lockdowns.

The following comparison charts depict Q3 earnings and revenue growth relative to recent periods, factoring in Amazon’s performance.

Image Source: Zacks Investment Research

Data reflects that nearly all of the earnings growth this quarter stems from Amazon. Other reported retail sector Q3 earnings have declined by 10.4%, despite a 3.8% rise in revenues, illustrating a broad impact of inflationary trends on sales growth.

Overall Q3 Earnings Season Summary

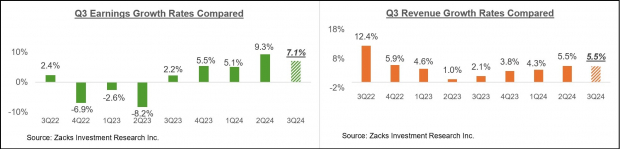

As of Friday, November 8th, results have been reported for 452 S&P 500 companies, accounting for 90.4% of the index’s total. An additional nine members are expected to report this week, including Disney, Applied Materials, Shopify, and Home Depot.

Collectively, the earnings of these 452 companies have risen by 7.1% year-over-year on 5.5% higher revenues. Notably, 73.5% of the firms have exceeded EPS estimates, while 61.5% have surpassed revenue expectations.

About 50.7% of these companies beat both EPS and revenue estimates. The following charts provide a historical context to the Q3 earnings and revenue growth rates, as well as EPS and revenue beats percentages.

Image Source: Zacks Investment Research

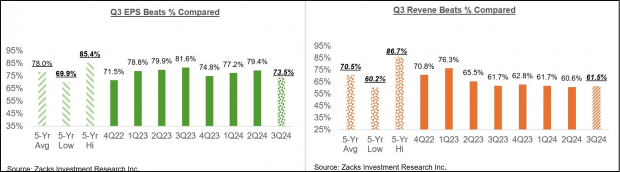

Another set of charts compares the Q3 EPS and revenue beats percentages historically.

Image Source: Zacks Investment Research

Lastly, the following charts display the revenue performance and blended beats percentage for these 452 companies.

Image Source: Zacks Investment Research

S&P 500 Earnings Show Stable Growth Amid Mixed Sector Performance

Key Earnings Insights

The growth trend for S&P 500 earnings appears stable, with a positive outlook. However, fewer companies have managed to exceed consensus estimates compared to recent quarters. Both earnings per share (EPS) and revenue beat percentages are currently below their 20-quarter averages for this group of companies.

Understanding Q3 Earnings

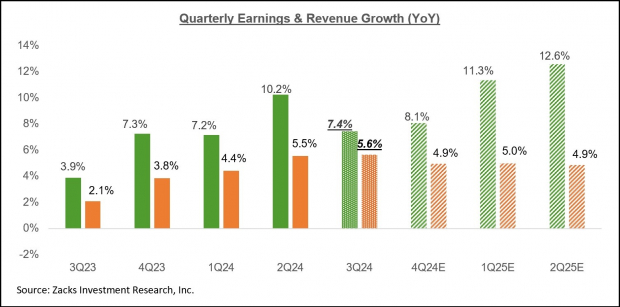

For the third quarter of the year, when considering reported results alongside estimates for upcoming reports, total earnings for the S&P 500 index are expected to rise by +7.4% compared to the same period last year, while revenues are projected to grow by +5.6%.

The chart below illustrates the growth rates in earnings and revenue for Q3, along with comparisons to the past four quarters and forecasts for the following three quarters.

Image Source: Zacks Investment Research

The performance of the Energy and Technology sectors has had opposing impacts on Q3 earnings growth. The Energy sector has exerted a downward influence, while the Technology sector has helped to lift it.

If not for the struggles in the Energy sector, the S&P 500’s Q3 earnings would have seen an increase of +9.9% instead of +7.4%. Excluding the strong contributions from the Technology sector, earnings growth for the other companies in the index would only be +2.6%. If we remove the influences of the largest firms in the Technology sector, known as the “Mag 7,” the overall earnings growth for the remaining 493 S&P 500 companies would be just +2.1%.

Looking forward to the final quarter of the year (2024 Q4), total S&P 500 earnings are anticipated to increase by +8.1% compared to the same time last year, with revenues rising by +4.9%.

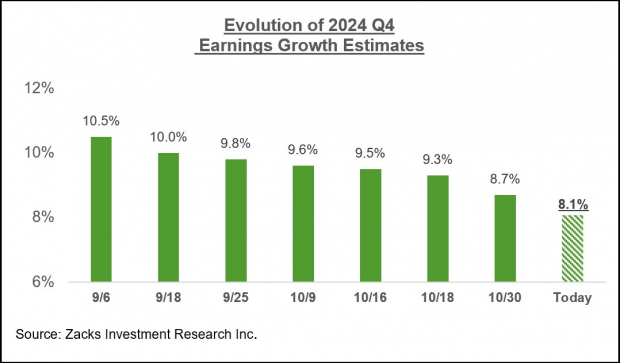

In contrast to the significant cuts in estimates seen before the Q3 earnings season, forecasts for Q4 have remained surprisingly stable, as shown in the chart below.

Image Source: Zacks Investment Research

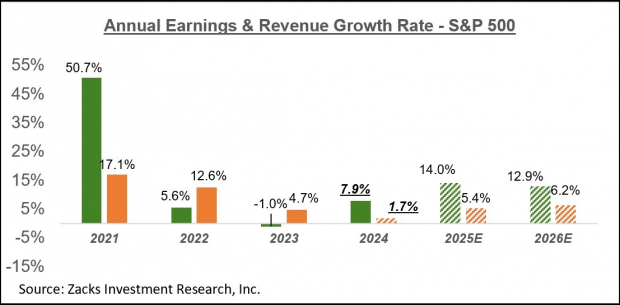

The next chart provides an overview of earnings trends on a calendar-year basis, illustrating this year’s projected earnings growth of +7.9%, followed by double-digit increases anticipated in 2025 and 2026.

Image Source: Zacks Investment Research

It’s important to highlight that this year’s +7.9% earnings increase improves to +9.8% when excluding the Energy sector.

For an in-depth examination of the earnings landscape and future expectations, refer to our weekly Earnings Trends report >>>> Breaking Down the Q3 Earnings Season Scorecard

Investing in Infrastructure: Five Stocks to Consider

With trillions of dollars in federal funds allocated to improve America’s infrastructure, significant investments are expected not just in roads and bridges, but also in AI data centers and renewable energy sources.

This spending surge presents opportunities, and you can discover five surprising stocks poised to benefit from this exciting trend.

Download “How to Profit from the Trillion-Dollar Infrastructure Boom” for free today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Lowe’s Companies, Inc. (LOW): Free Stock Analysis Report

The Home Depot, Inc. (HD): Free Stock Analysis Report

Read this article on Zacks.com

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.