“`html

Luke’s 30% Stock Gains: Boom Now, Bust Ahead?

Enjoy the rise in stock prices… but get ready for the drop.

This is financial expert Luke Lango’s straightforward forecast:

We predict a stock market boom from 2025 into 2026 fueled by economic optimism.

However, things could go wrong—perhaps due to inflation or excessive lending, or even issues in the labor market. There could be too much investment in AI without substantial returns, leading to a market downturn.

Thus, our investment strategy under potential Trump administration policies over the next year or two is simple: Remain entirely bullish now as long as the market trends upward.

Be ready to cash out and take a defensive stance when signs of trouble appear, likely around mid to late 2026.

Factors Supporting a Bull Market with Trump

Luke emphasizes two key factors that could drive growth: deregulation and increased corporate earnings.

With Trump back in office and the Republicans holding both the Senate and House, significant regulatory changes and a proposed reduction in the corporate tax rate from 21% to 15% could be on the table.

This would greatly enhance corporate profits and, consequently, stock prices. Luke shares some insights:

From November 2016, when Trump first won the presidency, to December 2017, earnings estimates rose by roughly 2% and 4% for 2017 and 2018, respectively.

This indicates that Trump’s policies contributed to notable increases in earnings estimates during his last term. We believe a similar outcome is realistic this time.

Additionally, Trump’s possible corporate tax cuts could lead to a 4% boost in earnings per share (EPS) for the S&P 500, according to Goldman Sachs.

Overall, we project an increase of 6% to 8% in earnings estimates over the coming years: 2% to 4% from pro-growth policies and another 4% from the corporate tax reduction.

This brings the 2026 EPS estimate for the S&P 500 of around $303 to $325 by next year.

What About Investor Sentiment?

Stock prices ultimately depend on two main factors: earnings and investor willingness to pay for those earnings, or “investor sentiment.”

Earlier, we reviewed the potential 6% to 8% gain in earnings under Trump’s policies. Now, let’s consider investor sentiment.

Luke notes:

In 2016, prior to Trump’s first term, the S&P 500 often traded between 16X and 18X forward earnings. In his first year, this expanded to a range between 18X and 19X.

This increase in valuations, about 10%, was likely due to heightened confidence in the economy.

We believe a similar expansion is possible this time as well.

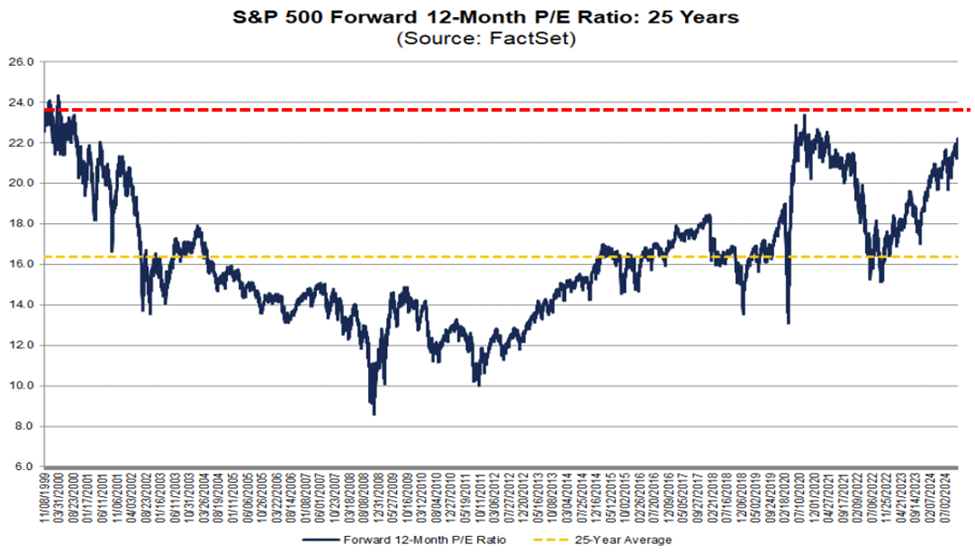

The S&P 500 has recently fluctuated between 20.5X and 22.5X forward earnings. A 10% increase suggests a forward earnings multiple around 23.5X for stocks.

Combining these two factors, Luke estimates a 2026 EPS of $325 for the S&P 500, leading to a 2025 target price of 7,640, reflecting nearly a 30% increase.

The Inevitable Bust: Understanding the Cycle

A downturn is coming, though the timing remains uncertain.

Luke explains:

If both earnings and valuations rise significantly, the market could reach “bubble territory.”

This aligns with a likely “Boom-Bust” cycle.

For context, Luke’s proposed 23.5X forward earnings multiple can be illustrated through a chart from FactSet, which contrasts this estimate against the 25-year average:

Source: FactSet

Luke anticipates 1.5 more years of market growth before a potential downturn, but there are no guarantees against earlier drops.

In his Innovation Investor Daily Notes, Luke notes that the S&P 500 is projected to increase by over 20% this year, having already done so last year. Historically, this has only occurred three times in the last century: 1935/36, 1954/55, and 1995/96.

After each of those instances, a market correction followed. Here’s a brief summary:

In 1937, after the 1935/36 bull run, stocks plummeted by about 40%.

After the 1954/55 increase, stock performance stagnated in 1956 before another drop in 1957.

Lastly, following the 1995/96 rally, the market enjoyed three more fruitful years, from 1997 through 1999, ultimately leading to the severe Dot Com Crash during 2000-2002.

While Luke’s analysis suggests we could have a longer period of gains, uncertainty always looms. This reinforces the importance of planning for market fluctuations.

“`

Understanding Your Investment Conviction: Strategies for Success

Classifying Your Investments: Low vs. High Conviction

Investment decisions can be divided into two categories: low-conviction and high-conviction. If you are making trades for short-term profits, where the outcome is uncertain and dependent on changing market indicators, you hold a low-conviction position. For these investments, your focus is primarily on capital protection, especially if the market turns against you.

In contrast, high-conviction holdings reflect long-term confidence in a company’s potential, often sustaining value over several years or decades. Even in a bear market, the price drop is expected and accepted as part of the investment journey. Your strategy revolves around enduring short-term fluctuations while benefiting from long-term growth through compounding returns and strategic contributions.

Right now, it’s crucial to identify which stocks in your portfolio fall into these categories. Without this clarity, emotional reactions during market volatility could lead to poor decisions, potentially delaying your retirement by years.

Dedicate some time this week to evaluate your stocks based on conviction levels. For each low-conviction stock, determine a stop-loss level that reflects its volatility, which can help you avoid premature selling or holding onto a losing position too long.

As for high-conviction stocks, consider the scenario where their value decreases by 40%. Calculate the potential dollar loss based on your current holdings. Assess whether you could withstand that scenario without panicking and selling. If that prospect feels unsettling, it may be wise to reduce your position to a more comfortable level.

Finding Balance: Combining Long-Term Investments with Short-Term Trades

Investor Louis Navellier is blending this approach in his personal strategy. While he continues to recommend buy-and-hold investments, particularly in sectors like AI, autonomous vehicles, and quantum computing, he is also identifying shorter-term trading opportunities. These sectors are poised for considerable growth in the coming years, and Louis aims to equip his subscribers with the right investments.

The current market environment, especially with varying sentiments regarding political developments, prompts Louis to seek out shorter-term opportunities while still maintaining his long-term positions. This strategy enables him to take advantage of positive market momentum while minimizing duration risk. His quantitative grading system informs precise buy and sell decisions, eschewing emotional biases.

Louis’ strategy focuses on trades lasting from about one month up to 12 months, depending on market conditions, aiming for quick returns. This is distinct from a buy-and-hold approach and refrains from relying on reinvested dividends; it’s designed for swift financial gains.

For those interested in shorter-term trading, technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) can provide critical insight to spot market reversals, enhancing your timing for buying and selling.

Prepare for Market Uncertainties: The Importance of Having a Plan

As we navigate this investment cycle, it’s important to recognize that we are entering the later stages. Historically, this phase can yield significant market returns. However, the eventual downturn can catch many investors off guard, leading to significant losses.

Analyst Luke suggests there is still potential for further gains, but being prepared for a sudden shift is essential. Take a few moments to consider your strategy so that you are equipped to handle any scenarios that may arise, helping to mitigate future regret.

Wishing you a good evening,

Jeff Remsburg