Apellis Pharmaceuticals APLS, in collaboration with Sobi, reported positive one-year results from the mid-stage study evaluating systemic pegcetacoplan to treat post-transplant recurrence of C3 glomerulopathy (C3G) and primary immune complex membranoproliferative glomerulonephritis (IC-MPGN).

Pegcetacoplan is being developed as a targeted C3 therapy that addresses the cause of these rare and debilitating kidney diseases.

Per the data readout, seven patients in the phase II NOBLE study, representing 64% of the patient population treated with pegcetacoplan for a year, achieved a reduction in C3c staining by two or more orders of magnitude of intensity from baseline.

Six patients in the study (55%), including the three IC-MPGN patients, showed zero C3c staining intensity, indicating that C3c deposits were cleared. Please note that excessive C3c deposits indicate disease activity, which can lead to kidney inflammation, damage and failure. However, clearance of such deposits and inflammation allows the kidney to recover, thereby prolonging its function.

Furthermore, it was observed that seven patients (64%) demonstrated zero inflammation, as measured by the activity score of the C3G histologic index, after one year of treatment, which is consistent with the C3c staining reduction trend.

Apellis had previously reported positive12-week data from the phase II NOBLE study of systemic pegcetacoplan for the C3G and IC-MPGN indications, where the candidate rapidly reduced disease activity. Management was impressed that such reductions in disease activity observed at the end of 12 weeks were sustained over the long term.

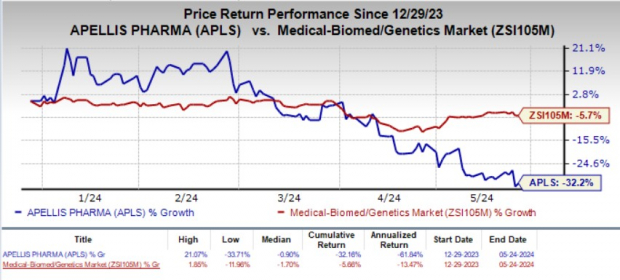

The stock gained 2.3% on May 24, following the encouraging news. Year to date, shares of APLS have plunged 32.2% compared with the industry’s 5.7% decline.

Image Source: Zacks Investment Research

The company also reported that pegcetacoplan was overall well-tolerated over the one-year treatment period. Adverse events were mostly mild-to-moderate in intensity and consistent with previously reported results.

The long-term findings from the NOBLE study were presented by Apellis at a recent medical conference.

Pegcetacoplan is simultaneously being evaluated in a phase III VALIANT study to treat post-transplant recurrence of C3G and IC-MPGN. Apellis and Sobi anticipate reporting top-line data from the late-stage study later this year.

Under the terms of the pegcetacoplan collaboration, Sobi is also evaluating the safety and efficacy of the candidate in a phase II study to treat patients with hematopoietic stem cell transplantation-associated thrombotic microangiopathy.

Pegcetacoplan monotherapy is already approved in the United States and EU under the brand name Empaveli/Aspaveli for treating adult patients suffering from paroxysmal nocturnal hemoglobinuria. The drug is also approved in several other geographies for the same indication.

In the first quarter of 2024, total Empaveli sales generated $25.6 million in revenues, representing year-over-year growth of 25%. Potential label expansion of Empaveli in additional indications will further increase the eligible patient population for the drug, thereby boosting its sales.

Empaveli therapy is also being evaluated for several other rare diseases across hematology and nephrology.

Apellis Pharmaceuticals, Inc. Price and Consensus

Apellis Pharmaceuticals, Inc. price-consensus-chart | Apellis Pharmaceuticals, Inc. Quote

Zacks Rank and Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are ALX Oncology Holdings ALXO, Annovis Bio ANVS and Entera Bio Ltd. ENTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73. Year to date, shares of ALXO have lost 11.6%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.35 to $2.46. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.82 to $1.95. Year to date, shares of ANVS have plunged 61%.

ANVS beat estimates in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

In the past 30 days, the Zacks Consensus Estimate for Entera Bio’s 2024 loss per share has remained constant at 25 cents. During the same period, the consensus estimate for 2025 loss per share has remained constant at 54 cents. Year to date, shares of ENTX have skyrocketed 286.7%.

ENTX’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 6.50%.

Highest Returns for Any Asset Class

It’s not even close. Despite ups and downs, Bitcoin has been more profitable for investors than any other decentralized, borderless form of money.

No guarantees for the future, but in the past three presidential election years, Bitcoin’s returns were as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts another significant surge in months to come.

Hurry, Download Special Report – It’s FREE >>

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Entera Bio Ltd. (ENTX) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.