Apple Beats Earnings Estimates Despite Decline in Yearly Profits

Earnings Overview and Future Expectations

Apple AAPL reported fourth-quarter fiscal 2024 adjusted earnings of $1.64 per share, surpassing the Zacks Consensus Estimate by 10.07%. However, GAAP earnings, which included a one-time income tax charge of 67 cents ($10.2 billion) from the reversal of the European General Court’s State Aid decision, stood at 97 cents—a decrease of 33.6% year over year.

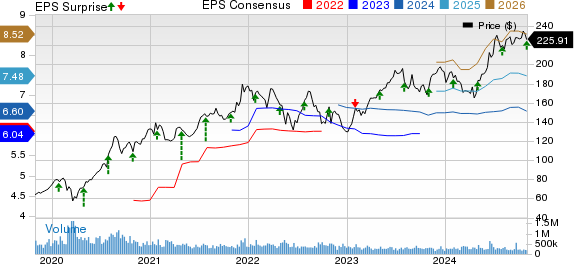

AAPL has outperformed the Zacks Consensus Estimate across all four previous quarters, with an average earnings surprise of 5.05%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Despite this positive earnings report, Apple shares fell more than 1.8% in pre-market trading. Year-to-date, Apple shares have risen 21.2%, lagging behind the Zacks Computer & Technology sector’s growth of 26.9% and the Zacks Computer – Micro Computers industry’s rise of 20.4%.

Apple Inc. Price, Consensus and EPS Surprise

Apple Inc. price-consensus-eps-surprise-chart | Apple Inc. Quote

When compared to its peers, AAPL shares have underperformed against Dell Technologies DELL and HP HPQ, while outperforming Lenovo. So far this year, Dell Technologies increased by 61.6% and HP rose by 18%, while Lenovo fell by 5.4%.

Year-to-Date Performance Chart

Image Source: Zacks Investment Research

Before examining AAPL’s investment outlook, it’s essential to review its quarterly performance.

Apple’s Q4 Performance Boosted by Services Growth

In the fourth quarter, net sales rose by 6.1% year over year, reaching $94.93 billion, which also exceeded the Zacks Consensus Estimate by 0.39%. However, unfavorable foreign exchange conditions negatively impacted net sales by 230 basis points (bps).

Services revenue saw a significant 12% increase from the previous year, amounting to $24.97 billion and constituting 26.3% of total sales. This figure also beat the consensus estimate by 0.59%.

Notably, Apple now boasts over 1 billion paid subscribers across its services, more than doubling its numbers over the past four years. Paid subscriptions experienced double-digit growth year over year in this quarter.

Sales of iPhones rose by 5.5% from the prior year, totaling $46.22 billion and making up 48.7% of total sales, also beating the Zacks Consensus Estimate by 0.59%.

Overall product sales—which constituted 71.8% of total sales—grew by 4.1% year over year, reaching $69.96 billion.

Weakness in China Sales Offset by Growth in Europe and Asia

Sales in Greater China dipped by 0.3% year over year. This decline was counterbalanced by robust performances in the Rest of Asia Pacific and Europe, which grew by 16.6% and 11%, respectively. Sales in the Americas increased by 3.9%, while Japan saw a rise of 7.6%.

Mac and iPad Sales Rise, Wearables Decline

Combined revenues from non-iPhone products (iPad, Mac, and Wearables) increased modestly by 1.5%.

Mac sales reached $7.74 billion, which was a 1.7% increase from the same quarter last year, accounting for 8.2% of total sales, and exceeded the Zacks Consensus Estimate by 4.19%.

iPad sales amounted to $6.95 billion—a 7.9% rise year over year—making up 7.3% of total sales and also surpassing the consensus mark by 0.31%.

However, sales from Wearables, Home, and Accessories decreased by 3% year over year to $9.04 billion, representing 9.5% of net sales, yet they exceeded the consensus estimate by 4.67%.

Improved Gross and Operating Margins

Apple’s gross margin expanded year over year to 46.2%, an increase of 110 bps. However, it contracted sequentially by 30 bps due to an unfavorable product mix.

The gross margin from products improved by 100 bps to 36.3% due to a favorable product mix, while the Services gross margin remained steady at 74%.

Operating expenses grew by 6.2% year over year to $14.29 billion, driven by a 6.3% rise in research and development costs, alongside a 6% increase in selling, general, and administrative expenses.

In terms of operating margin, Apple expanded it by 100 bps year over year to reach 31.2%.

Apple Maintains a Robust Balance Sheet

As of September 29, 2024, Apple’s cash and marketable securities totaled $156.65 billion compared to term debt of $106.63 billion.

In the reported quarter, Apple returned nearly $29 billion to shareholders through dividend payments ($3.8 billion) and stock buybacks ($25 billion).

Outlook for Future Revenues Driven by Services

Looking ahead, Apple anticipates revenue growth of low to mid-single digits year over year for the December quarter (first-quarter fiscal 2025). The company expects the Services segment to maintain a similar double-digit growth rate as seen in fiscal 2024.

For the first quarter of fiscal 2025, the gross margin is expected to range between 46% and 47%, while operating expenses are anticipated to be between $15.3 billion and $15.5 billion.

AAPL: Should You Buy, Sell, or Hold After Q4 Earnings?

Apple has remained a focus for investors largely due to its push into artificial intelligence, highlighted by the launch of Apple Intelligence—an advanced personal assistant integrated within iOS 18, iPadOS 18, and macOS Sequoia. Currently, these features are available in U.S. English for iPhone, iPad, and Mac users.

The anticipated advancements in AI could foster consumer-oriented, AI-enabled devices, potentially boosting shipments over the long run.

Nonetheless, AAPL appears to have limited upside in the short term. Its future growth depends significantly on the success of Apple Intelligence, the benefits of which are arguably already reflected in current stock prices.

Currently, Apple’s valuation appears stretched, as indicated by a Value Score of D, suggesting an elevated risk level for the stock.

In terms of forward 12-month Price/Earnings ratio, AAPL is trading at 29.77X, above the sector average of 26.93X.

Price/Earnings Ratio (F12M)

Image Source: Zacks Investment Research

Currently, Apple holds a Zacks Rank of #3 (Hold), suggesting that it may be wise for investors to wait for a more favorable entry point.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team has identified a selection of five stocks with the highest probability of doubling in value over the upcoming months. Among these, Director of Research Sheraz Mian highlights one stock poised for significant growth.

This standout pick is recognized as one of the most innovative financial firms, boasting a rapidly expanding customer base (over 50 million) and an array of cutting-edge solutions. It is positioned for substantial gains. While not all our selections guarantee success, this one holds potential for even greater returns compared to previous Zacks picks like Nano-X Imaging, which surged by +129.6% in just over nine months.

Free: See Our Top Stock And Four Runners Up. Interested in the latest recommendations from Zacks Investment Research? You can download the list of 5 Stocks Set to Double for free.

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

HP Inc. (HPQ): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.