Reassessing Apple’s Position

Apple Inc. (NASDAQ:AAPL) finds itself downgraded amid worries over iPhone 15 sales, notably in China. An atmosphere of skepticism has descended. However, in the face of these concerns, it may be that the prevailing pessimism is exaggerated. Despite sluggish product sales, Apple’s services business, nurtured by a vast base of over 2 billion active devices, appears capable of maintaining modest growth. The Indian market, alongside other emerging markets, provides a fertile ground for Apple to augment its market share. Hence, a hold rating seems warranted for the stock.

Anticipating Q1 Earnings

Forecasts suggest a slump in iPhone sales attributable to fierce competition from Huawei and decreased consumer expenditure in China. The company’s management’s commentary on recent modifications in the App Store is noteworthy, given the potential implications for the 2024 services unit growth. The adoption of pricier iPhone Pro Max models may elevate gross margins. Expectations linger around buybacks, projected to hover between $20 billion and $22 billion. Apple could potentially expand these buybacks, considering its ample cash reserves.

Finding Hope in Services

Despite the pressures on iPhones and watches, services continue to illuminate Apple’s trajectory. The consistent growth of services sales at an average of 13.5% over four quarters may endure, barring regulatory actions that impact Google’s licensing fee to remain the default search engine on Apple devices. Double-digit growth in the services segment throughout 2024 appears conceivable.

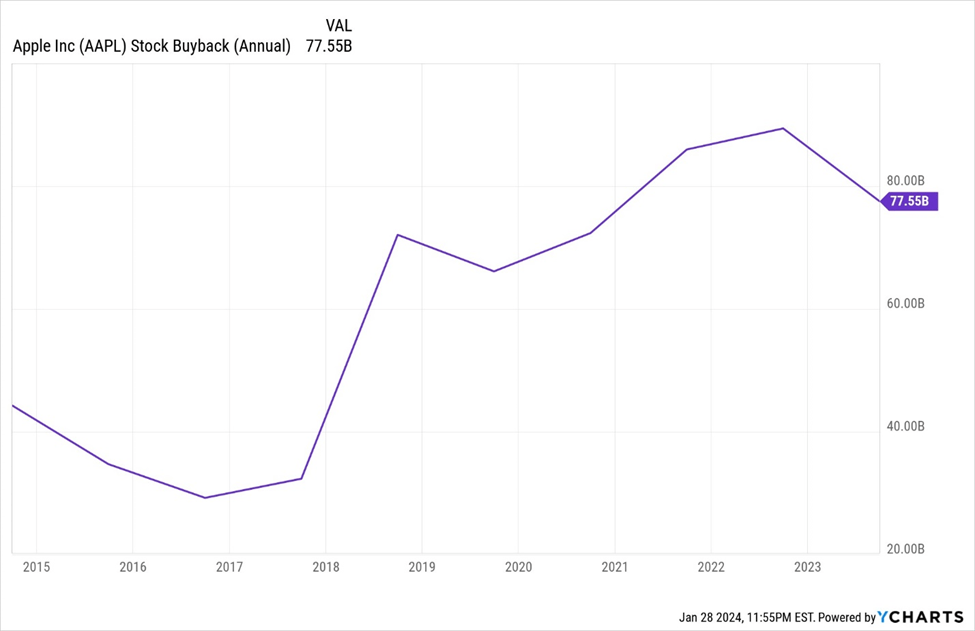

Robust Shareholder Returns

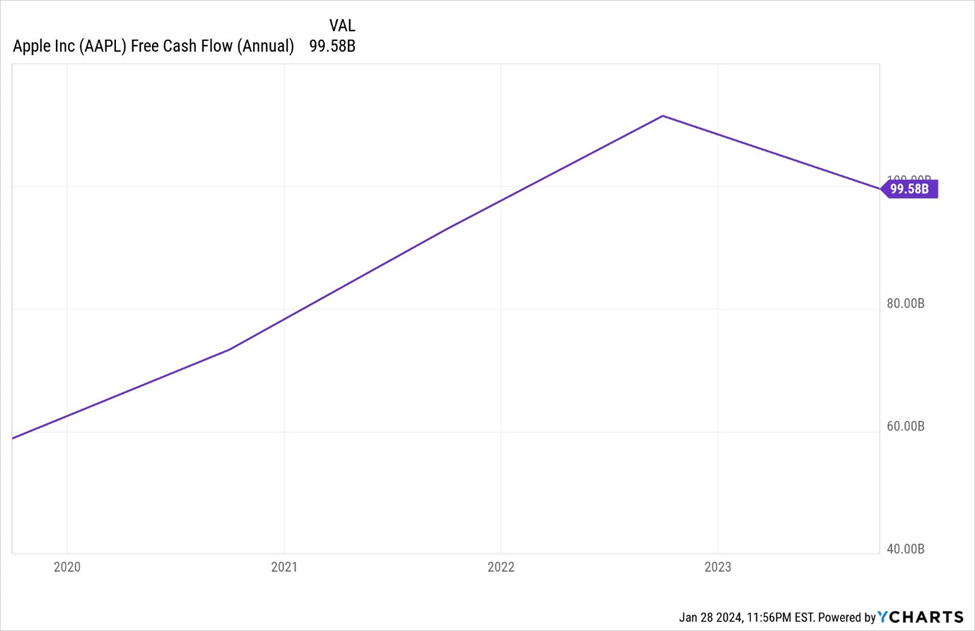

Apple seems poised to break records with its shareholder cash returns in 2024, utilizing a blend of fresh debt and existing cash reserves. Notably, the company has returned over $812 billion to shareholders since 2012, averaging around $24 billion per quarter in the past year. Anticipated expansion in quarterly returns, possibly reaching approximately $28 billion, could materialize over the next 12-24 months.

Apple’s annual free cash flow, expected to surpass $100 billion in fiscal 2024, may delay achieving a cash-neutral status. This unless the company alters its capital allocation policy or focuses on mergers and acquisitions. While maintaining historic highs in share repurchases and dividends, Apple sustains a sturdy credit rating, upheld by its resilient business ecosystem and substantial cash reserves. The company’s last fiscal quarter witnessed a return of $24.6 billion to shareholders through stock buybacks and dividends, with this trend likely continuing in the short-to-medium term.

Debut of Vision Pro Mixed-Reality Headset

Apple’s introduction of the $3,499 Apple Vision Pro mixed-reality headset on February 2 may spark excitement, although its impact on overall sales may not offset potential iPhone sales weaknesses in China. The projected sales figures of the headset, however, seem relatively modest in the context of Apple’s total revenue for 2024. It seems plausible that the headset may necessitate several iterations to gain traction among developers and for pricing to cater to a larger segment of Apple’s US iPhone user base.

Assessing Valuation

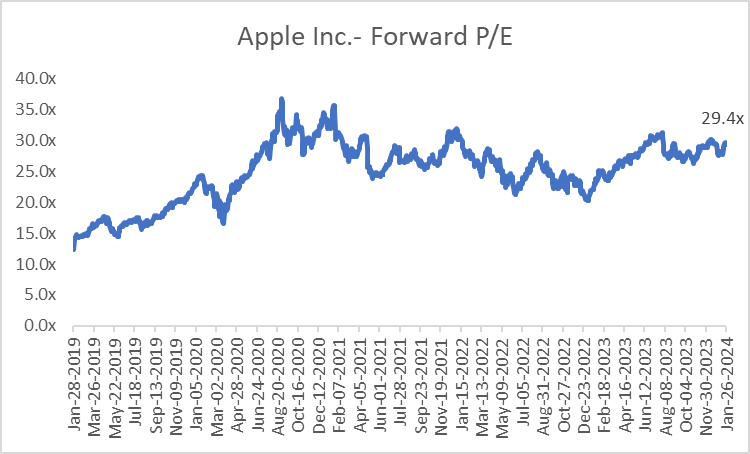

AAPL shares, once in the mid- to high-teens range pre-pandemic, underwent re-rating to a low-20s to low-30s range. This was fueled by the resilience of its product suite, robust cashflows, and burgeoning services growth. Consequently, Apple’s valuation multiple surged by over 50% in 2023 and doubled in the past five years. However, with the growth deceleration and mounting competition in China, the potential for further expansion of the multiple seems limited.

Final Thoughts

While the prevailing pessimism surrounding Apple may be exaggerated, the company confronts substantial headwinds that could significantly impact its growth in the near term. Bearing an elevated multiple, there seems to be little room for expansion from this point. Consequently, a cautious stance and a hold rating appear prudent for the stock.