Apple’s Earnings Cause Market Apathy; Buffett’s Stake Sparks Discussion

Apple (NASDAQ: AAPL) recently released its fiscal year 2024 fourth-quarter earnings, leaving investors largely unmoved. Although the stock has dipped slightly following the report, it remains up 25% over the past year, a positive sign for a company boasting a substantial $3.3 trillion market cap.

Berkshire Hathaway Reduces Apple Holdings: What It Means for You

In addition to Apple’s earnings, its major investor, Berkshire Hathaway, disclosed its own results. The company, led by renowned investor Warren Buffett, has decreased its Apple stake significantly, from over $170 billion down to around $66 billion.

While it’s natural to consider Buffett’s moves when thinking about your investment choices, it’s essential to remember that his decisions may not directly relate to your situation. Despite selling a large chunk of Apple stock, Buffett has maintained a positive view of the company’s potential, even declaring it superior to American Express and Coca-Cola earlier this year.

Understanding Apple’s Rising Valuation

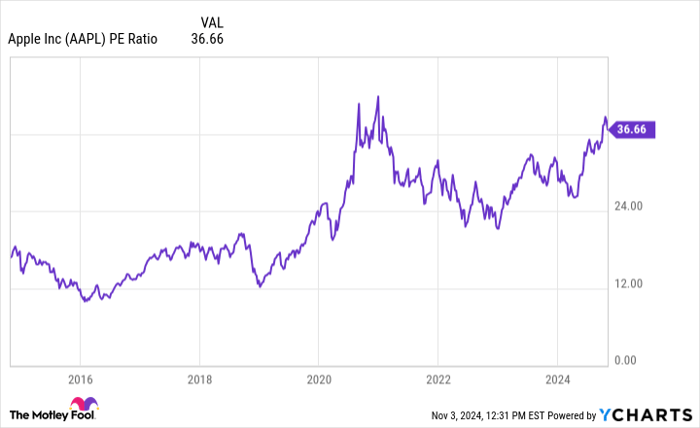

Apple’s price-to-earnings (P/E) ratio has climbed significantly over the last eight years, reflecting its transition to a more efficient business model. The company’s growing customer base, especially through iOS devices like the iPhone, has allowed it to expand its highly profitable subscription services. This year, service revenues made up approximately 24.5% of total sales, a rise from 22.2% in 2023.

With improved efficiency and returns on invested capital (ROIC), it’s clear why Apple’s valuation has increased. Those looking for lower-price earnings ratios are likely to be disappointed; Apple simply isn’t going back to trading at 12 times earnings without significant market declines.

Investment Outlook: Buy, Sell, or Hold?

Despite Apple’s better efficiency leading to higher profits, the stock’s current valuation doesn’t indicate a bargain. Although the company introduced Apple Intelligence, an artificial intelligence feature in iOS 18, recent revenue growth of 6% in Q4 has set low to mid-single-digit growth expectations for the next quarter. It will take time for new features to reflect on the balance sheet.

Apple reported earnings of $6.08 per share for 2024, with analysts forecasting a 21% increase to $7.40 in fiscal year 2025, followed by an 11% rise to $8.25 in the following year. Analysts generally expect a 12% annual earnings growth rate over the next three to five years. Despite being a strong business, with a PEG ratio of around 3, Apple’s valuation appears a bit stretched for its expected growth.

Investors should appreciate Apple’s solid business model without rushing to buy at the current price. Holding onto Apple seems prudent until a more appealing valuation emerges, or until growth expectations stabilize.

Could This Be a Second Chance for Smart Investments?

Have you ever felt like you missed the opportunity to invest in successful stocks? Now could be your moment.

Our analysts occasionally issue a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. Don’t worry if you feel you’ve missed your chance; consider the following:

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $22,469!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $42,271!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $411,970!*

Currently, we’re identifying three potential “Double Down” stocks deserving of your attention, and the window to act may be closing fast.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

American Express is an advertising partner of Motley Fool Money. Justin Pope holds no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.