Market Struggles Amid Apple’s Decline and Bank Earnings Roll-Out

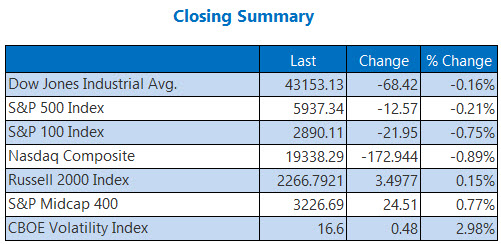

Despite a positive start to earnings season, major indexes, including the S&P 500 and Dow, couldn’t maintain their upward momentum. The Nasdaq also dipped, particularly affected by Apple’s (AAPL) steep decline following a report from Canalys indicating the tech giant is losing ground in China. Meanwhile, the 10-year U.S. Treasury yield retreated from a 14-month high, and the Cboe Volatility Index (VIX) ended a three-day drop.

Read on to find out more about today’s market developments:

- Big bank earnings continue to be announced.

- A reminder of another holiday-shortened trading week ahead.

- Details on two significant analyst shifts today; retail stock tumbles post-guidance update.

Key Highlights of the Day

- In his last speech, U.S. President Joe Biden cautioned against the rise of a possible oligarchy as President-elect Donald Trump prepares to take office next week. (Reuters)

- American Express (AXP) will pay $230 million to settle allegations from the Department of Justice regarding fraud and marketing deception. (CNBC)

- Southwest Airlines stock faced a downgrade.

- Netflix stock surged following a positive pre-earnings note.

- A disappointing forecast affected a popular retail stock.

Oil Prices Drop; Gold Prices Rise

Crude oil prices dropped as global supply concerns subsided after news of a cease-fire between Israel and Hamas. February-dated West Texas Intermediate (WTI) crude declined by 75 cents, or 1%, closing at $79.29 per barrel.

In contrast, gold prices surged to a one-month high, fueled by ongoing inflation worries and a falling 10-year U.S. Treasury yield. February delivery gold climbed 1.1%, settling at $2,748.60 an ounce.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.