Apple Inc AAPL shareholders are gearing up for a seismic shift in the market. Amid the ongoing quarterly rebalancing of index funds, a rare triple witching event is adding fuel to the financial fire, stoking market volatility to new heights.

Unprecedented Rebalancing Sets Stage for Apple’s Triumph

With a staggering $250 billion shuffle in stock positions, the iconic iPhone maker stands to reap substantial rewards as a key player in the chaos.

An important development stems from Berkshire Hathaway BRK divesting its stake, prompting index providers to recalibrate Apple’s market weight. This maneuver pushes the tech giant from Cupertino, California to the forefront of S&P 500 tracking funds.

Apple Overtakes Microsoft with Forceful Market Cap

Apple’s staggering market cap of $3.48 trillion now eclipses that of Microsoft Corp‘s MSFT at $3.26 trillion, firmly establishing the tech trailblazer as the crowning jewel in the SPDR S&P 500 ETF SPY.

As funds undergo rebalancing, a colossal $35 billion worth of Apple shares are set to change hands, potentially offering substantial backing for its stock price. This realignment could further propel the bullish trajectory Apple has enjoyed so far this year, with the stock already surging over 24%.

Related: Apple Revenue Growth ‘Just Too Slow For Investors To Get Excited About’: Analyst Points to Advertising As Future Catalyst

Optimism Abounds Amid Bullish Signals

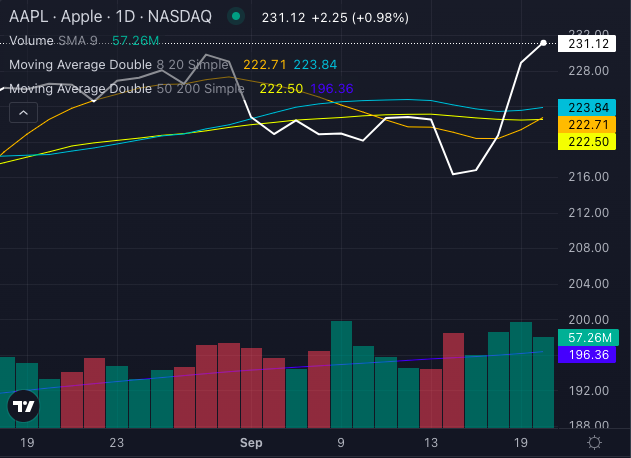

Apple’s stock chart exudes strength, signaling a continued bullish run.

Chart created using Benzinga Pro

With the stock trading above key moving averages — five, 20, and 50 days — the technical outlook heavily favors buyers. Priced at $231.12, the stock comfortably sits above its eight-day SMA of $221.71 and 20-day SMA of $223.84, delivering a consistent bullish signal across various indicators.

Chart created using Benzinga Pro

The Moving Average Convergence Divergence (MACD) indicates growing buying pressure with a positive reading, while the Relative Strength Index (RSI) standing at 63.00 (and climbing) suggests that Apple, approaching overbought levels, still retains its bullish momentum.

Aligned with positive technical indicators, the rebalancing evokes confidence among investors, fueling expectations of Apple’s potential to reach new heights.

Explore More:

Market News and Data brought to you by Benzinga APIs