Apple’s Stock Faces Challenges Amid Slowing Growth and High Valuation

While it’s encouraging for investors to see companies reach new records in revenue or earnings, climbing debt and inflated valuations can signal trouble. Recently, Apple (NASDAQ: AAPL) made headlines for a concerning reason that investors should be aware of as 2025 approaches.

Apple’s Growth Hits a Standstill

For years, Apple has dominated as a leading consumer brand, with iPhones, Apple Watches, AirPods, and Mac computers becoming staples for many users across the U.S. However, recent trends suggest the company’s growth may have peaked.

A lack of significant new products or technologies has left Apple stagnant. The iPhone, which generates the bulk of revenue for the company, has not seen rapid sales growth in recent times.

| Year | Q4 iPhone Revenue | YOY Growth |

|---|---|---|

| 2024 | $46.2 billion | 5.5% |

| 2023 | $43.8 billion | 2.8% |

| 2022 | $42.6 billion | 9.5% |

Data source: Apple. Note: Q4 ends around Sept. 30, varying slightly each year.

The mid-single-digit percentage revenue growth signifies that Apple might be reaching its peak. Significant changes are unlikely unless the company introduces new products or increases prices. Despite this, the stock is priced as if it’s experiencing much faster growth.

Apple’s Valuation Soars Amidst Stagnation

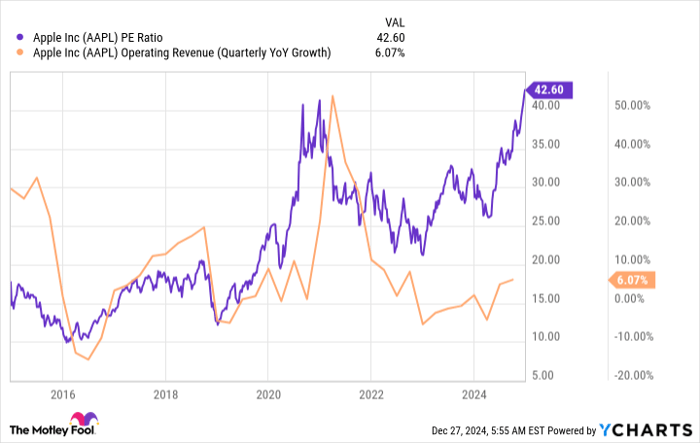

Currently, Apple’s stock is valued at a decade-high level, which raises concerns. Historically, while Apple has traded at high price-to-earnings (P/E) ratios, this is the first occurrence during a period when iPhone sales dominate its revenue.

Analysis shows that the last time Apple’s valuation approached 40 times its trailing earnings, its revenue growth was above 50% year over year. With present growth rates significantly lower, current valuations appear inflated, considering the company may not sustain such pricing over time.

Given this scenario, a correction to more traditional valuation levels seems inevitable.

What Declines Could Investors Anticipate?

As Apple’s growth lags behind the broader market, there’s less justification for its premium over the S&P 500 (SNPINDEX: ^GSPC). The S&P 500 holds a trailing P/E ratio of 25.2 and a forward P/E of 21.9, suggesting that Apple may align closer to these figures if it continues on its current growth path.

Wall Street analysts forecast a 6% increase in Apple’s revenue for the fiscal year 2025 (ending September 2025), followed by 8% growth in fiscal year 2026, indicating this slower trajectory is expected to persist.

If Apple’s stock valuation declines to a P/E ratio of 30, its stock price could drop nearly 30%. A further decline to a P/E of 25, in line with the S&P 500, would imply a more than 40% drop. While exact figures may vary with earnings growth counterbalancing some declines, a price correction is likely given the stock’s inflated valuation.

Currently, Apple offers few reasons for investors to prioritize it over other major tech companies. The slow growth rate coupled with its lofty valuation poses concerns. Notably, even prominent investors like Warren Buffett have started to reduce their holdings in Apple over the past year.

Why This Might Be Your Chance for Smart Investing

Have you felt like you missed out on investing in top-performing stocks? Now is the time to pay attention.

Occasionally, our expert analysts identify stocks they believe are poised for significant growth, termed “Double Down” recommendations. For those concerned about missing investment opportunities, this could be the prime moment to act.

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $355,269!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,404!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $489,434!

Currently, we’re issuing “Double Down” alerts for three promising companies, and such opportunities may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and may not reflect those of Nasdaq, Inc.