Arkema Signs Key Biomethane Supply Agreement with ENGIE

Arkema S.A. (ARKAY) has established an eight-year contract with ENGIE to provide biomethane to its Bostik plants in France, marking a significant move toward sustainable industrial practices.

Key Financial Details of the Agreement

This innovative agreement, worth 25 GWh per year, will supply roughly 85% of the annual gas needs for four Bostik facilities located in Coubert, Privas, Ribécourt, and Venette. This deal is a crucial advancement in Arkema’s strategy to decarbonize its energy supply. It complements the long-term biomethane contract that Arkema secured with ENGIE earlier in 2023, which encompasses a total annual supply of 300 GWh in France.

Commitment to Carbon Footprint Reduction

This contract exemplifies Arkema’s ongoing commitment to reducing its carbon footprint while supporting its customers in their sustainability initiatives. The company’s diverse portfolio features innovative solutions that cater to the growing demand for environmentally-friendly materials, based on its extensive materials science expertise.

Stock Performance and Market Position

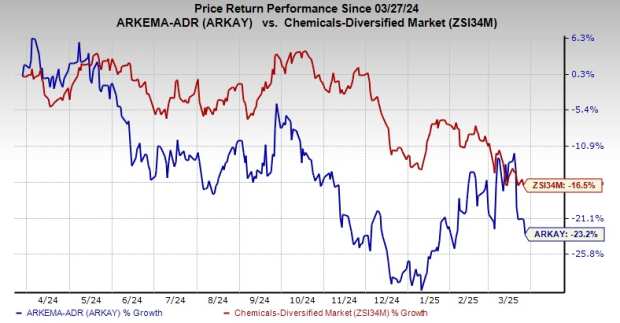

Over the previous year, Arkema’s shares have declined by 23.2%, in contrast to a 16.5% drop in its overall industry. Investors are closely monitoring the company’s efforts in sustainability as they assess its market performance.

Image Source: Zacks Investment Research

ARKAY’s Rank and Alternatives

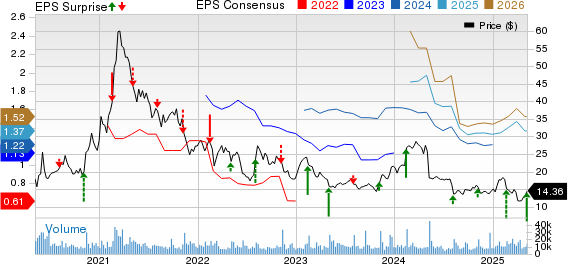

Currently, Arkema holds a Zacks Rank of #4 (Sell). However, there are other companies in the basic materials sector that have received higher rankings.

Companies such as Carpenter Technology Corporation (CRS), CSW Industrials Inc. (CSWI), and Axalta Coating Systems Ltd. (AXTA) enjoy better rankings on the Zacks scale. Carpenter Technology, rated Zacks Rank #2 (Buy), has consistently surpassed earnings expectations with an average surprise of 15.7% over the last four quarters, propelling its shares up by 169.6% over the past year.

The Zacks Consensus Estimate for CSW Industrials’ current fiscal-year earnings stands at $8.50. This company also has a Zacks Rank of #2 and has consistently beaten earnings expectations with an average surprise of 10.1%, resulting in a 28.4% increase in its share price within the last year.

Axalta Coating Systems, holding the highest Zacks Rank of #1, has shown strong performance, exceeding consensus estimates each quarter and delivering an average earnings surprise of around 16.3%, with a 1.2% increase in share value over the past year.

Investment Insights

For those considering investment options, accessing a comprehensive list of Zacks’ recommended stocks may provide valuable insights. For just $1, investors can explore various portfolio services, including Surprise Trader, Stocks Under $10, and Technology Innovators, which have yielded impressive double- and triple-digit returns in recent times.

Free Stock Analysis Report: Carpenter Technology Corporation (CRS)

Free Stock Analysis Report: Arkema SA (ARKAY)

Free Stock Analysis Report: Axalta Coating Systems Ltd. (AXTA)

Free Stock Analysis Report: CSW Industrials, Inc. (CSWI)

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.