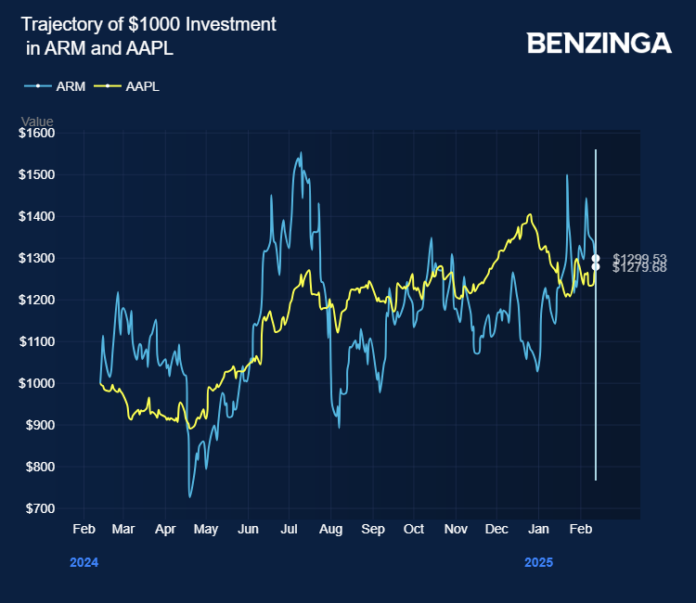

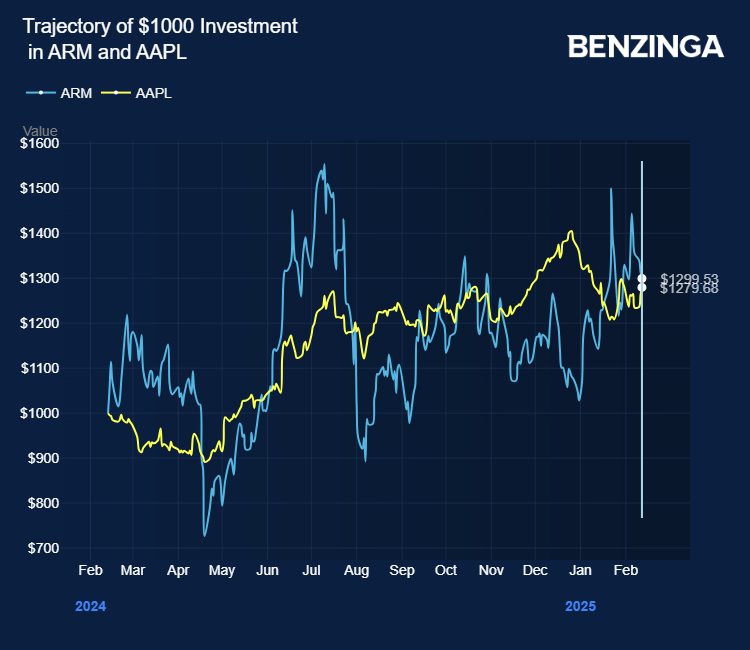

Arm Holdings Plc ARM, a British chip designer, has seen its stock jump over 155% since its initial public offering (IPO) in September 2023. This impressive rise has paved the way for its inclusion in the Nasdaq 100 index. Arm primarily designs chips that power smartphones, including the iPhone from Apple Inc AAPL.

AI’s Role in Growth Aspirations

CEO Rene Haas expressed his belief that advancements in artificial intelligence (AI) will significantly boost growth opportunities for both the smartphone and Arm industries.

Also Read: SoftBank Q3 Earnings: Revenue Rises, Vision Fund Takes $2.33 Billion Hit As Investments Falter

Arm’s Performance Compared to the Sector

The stock of Arm Holdings has risen by 26% year-to-date, contrasting sharply with the S&P Semiconductors Select Industry Index, which has seen a decline of 4.3%.

Ambitions to Dominate the PC Market

Haas aims for Arm to secure over 50% of the Windows PC market within the next five years, additionally projecting that by 2025, there could be 100 billion AI-ready Arm devices worldwide. In 2024, Microsoft Corp MSFT will roll out Windows PCs equipped with AI features powered by Arm chips, which may intensify competition with Apple’s Mac computers.

Tech Giants Backing Arm’s Architecture

Companies like Amazon.Com Inc AMZN and Alphabet Inc’s GOOG GOOGL Google are investing in data centers that utilize a mix of Arm architecture and their own chip designs, shifting away from Intel Corp’s INTC x86. Arm-based chips are increasingly featured in Nvidia Corp’s NVDA latest AI systems.

Financial Resilience and Growth Potential

Arm enjoys robust gross margins of 95%-96% because it designs and licenses semiconductor intellectual property rather than manufacturing chips. This model allows Arm to earn both upfront fees and ongoing royalties from each chip made using its designs. The company’s research and development margin has grown significantly, rising to 61% in fiscal 2024 from 42% the previous year.

Looking Ahead: New Initiatives and Challenges

Recently, CEO Rene Haas announced that Arm is expanding its role in AI infrastructure, notably through participation in OpenAI’s $100 billion Stargate AI infrastructure project. Plans are in place to increase prices by up to 300%, and there are discussions about manufacturing its own chips.

Since 2019, Arm has been strategizing to boost smartphone revenue by around $1 billion over the next decade, aiming to increase royalty rates linked to its latest Armv9 computing architecture.

Haas is also considering the production of complete chips or chipsets, potentially posing as a competitor to existing partners like Apple and Qualcomm. A licensing dispute between Arm and Qualcomm Inc QCOM could disrupt the delivery of new AI-powered laptops.

Analysts Weigh In

Wall Street analysts, including Srini Pajjuri from Raymond James, have expressed positive sentiments regarding the Armv9 CPU architecture and advancements in compute subsystems (CSS), which could significantly enhance the royalty rate. They foresee the growth of AI agents and more efficient AI models as promising prospects for Arm’s future.

Charles Shi from Needham remarked that Arm is exceeding its fiscal 2025 targets set during the IPO and is transitioning from a licensing-based growth model to one driven by royalties.

Nevertheless, analysts have pointed out ongoing risks, such as exposure to China, which has historically made up 20% of Arm’s sales, along with headwinds in the smartphone, networking, and automotive sectors.

Management Changes in Arm China

In other news, Arm China appointed Chen Feng as its sole CEO after co-CEOs Liu Renchen and Eric Chen stepped down. These executives had been leading Arm China on an interim basis since the company terminated Allen Wu in 2022 due to alleged conflicts of interest.

Historical Ownership Context

SoftBank Group Corp SFTBF SFTBY acquired Arm in 2016 for $32 billion and still holds 90% ownership.

Current Stock Performance

The price of ARM stock closed at $155.41 on Wednesday.

Also Read:

Photo via Shutterstock

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs