EOG Resources: Navigating Market Challenges with Proven Strategies

Overview of EOG Resources’ Market Position

With a market cap of $71.9 billion, EOG Resources, Inc. (EOG) stands out as a prominent upstream energy company focused on the exploration, development, and production of crude oil, natural gas, and natural gas liquids. Headquartered in Houston, Texas, EOG operates in key resource basins throughout the United States and also internationally in Trinidad and Tobago and China.

Current Stock Performance

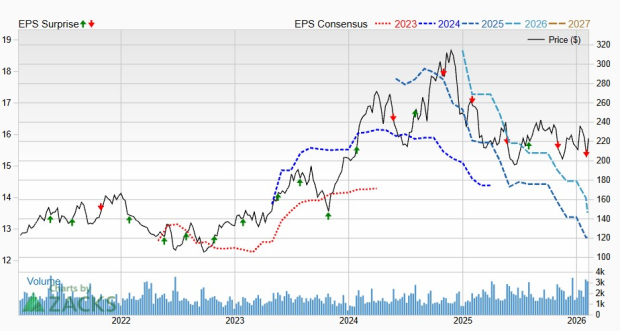

Although EOG Resources is classified as a “large-cap” stock, having a valuation of $10 billion or more, it has experienced an 8.3% decline from its 52-week high of $139.67. Over the past three months, EOG shares have increased by 7.3%, trailing the broader Dow Jones Industrials Average’s ($DOWI) 8.9% gain.

Year-to-Date and 52-Week Performance

Looking at a longer timeline, EOG’s stock has risen by 5.6% year-to-date, although this lags behind the Dow’s impressive 17.7% increase. Over the past 52 weeks, EOG shares are up 7.3%, while the Dow Jones boasts a remarkable 22.4% return.

Positive Trends Despite Challenges

EOG Resources appears to be on a positive trend, trading above both its 50-day and 200-day moving averages since November.

Q3 Earnings Report Insights

On November 7, EOG reported a revenue miss in Q3; however, shares rose 6.1% the next day due to higher-than-expected earnings per share of $2.89, which surpassed analysts’ consensus estimates. Investors reacted positively to a 7.7% year-over-year increase in total volumes, which exceeded guidance, and a 7% dividend increase, reflecting confidence in future cash flows. EOG also demonstrated solid free cash flow generation of $1.5 billion coupled with a robust liquidity position, enhancing market sentiment.

Comparative Performance with Competitors

In contrast, EOG’s competitor, Canadian Natural Resources Limited (CNQ), is facing challenges with a 1.2% year-to-date decline and a 3.8% increase over the past year, indicating EOG’s stronger performance in this competitive landscape.

Analysts’ Outlook

While EOG has underperformed relative to the Dow over the past year, analysts maintain a moderately optimistic view of its future. The stock holds an overall consensus “Moderate Buy” rating from 28 analysts. Presently, it is trading below the mean price target of $145.56.

On the date of publication, Sohini Mondal did not hold (directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For further details, please refer to the Barchart Disclosure Policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.