Liberty Energy Inc. LBRT, a prominent provider of hydraulic services and technologies for North America’s oil and natural gas sector, is facing tough times in its recent performance. The company specializes in hydraulic fracturing, wireline services, proppant delivery, and other complementary offerings that help support the operations of oil and gas companies. However, Liberty’s latest financial report has raised alarm bells for investors.

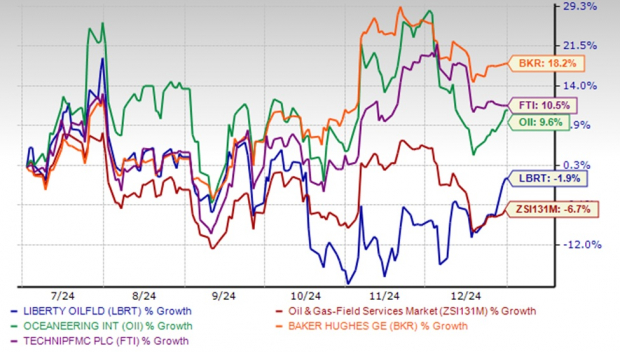

Over the last six months, Liberty Energy has seen a decline in its share price of 1.9%, while some of its competitors like Baker Hughes BKR, TechnipFMC FTI, and Oceaneering International OII have enjoyed notable share price increases of 18.2%, 10.5%, and 9.6%, respectively.

Image Source: Zacks Investment Research

Q3 Performance Falls Short

In its latest report, Liberty Energy announced an adjusted net income of 45 cents per share for the third quarter of 2024, which fell below the Zacks Consensus Estimate of 55 cents. This shortfall was primarily attributed to weak performance in equipment and services, as well as reduced activity during the quarter.

For the most recent EPS estimates and surprises, check out the Zacks Earnings Calendar.

Several factors are weighing on Liberty’s stock, from pricing pressures and declining profitability to uncertainties in capital spending and the cyclical nature of the industry. With that context, it is essential to assess whether it is advisable to hold or sell LBRT stock going forward.

Key Factors Hurting LBRT

Pricing Pressures: The hydraulic fracturing industry is facing pricing challenges due to excess capacity and decreasing demand as the year winds down. Liberty’s management noted that these declining activity levels are putting pressure on service prices, which could squeeze profit margins.

Dropping Revenues and Profitability: In the third quarter of 2024, Liberty’s revenues fell 2% sequentially, while net income significantly dropped from $108.4 million in the second quarter to $73.8 million. Adjusted EBITDA also showed a decline, further indicating pressures on profitability.

Image Source: Liberty Energy Inc.

Increased Capital Expenditures: Although Liberty actively manages its capital expenditures, investments in technology and new fleets may impact cash flows if expected market improvements do not occur. There remains uncertainty about future investments in power generation, which could affect financial stability.

Industry Cyclicality: Liberty’s performance is closely linked to the oilfield services sector, which experiences cyclicality. Shifts in oil and gas prices and changes in drilling activities can directly influence Liberty’s operations and financial standing.

Temporary Activity Reduction: In response to lower demand, Liberty has decided to reduce its fleet count temporarily, which may further impact revenues in the upcoming quarters. While the company plans to reactivate fleets based on demand, the specifics of timing and extent remain uncertain.

Conclusion: Caution Advisable for LBRT Investors

Liberty Energy faces considerable challenges that have affected its stock performance, including pricing pressures, declining revenues, higher capital expenditures, and exposure to industry cyclicality. Although the company is managing its investments and adjusting its operations, prevailing uncertainties about market conditions and the temporary reduction in fleet deployment indicate potential short-term hurdles. With the company’s current Zacks Rank #4 (Sell), it may be wise for investors to steer clear of LBRT stock for now and consider other options within the oil and gas sector.

You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recently Released: Zacks Top 10 Stocks for 2024

Don’t miss your chance to get in early on our top ten stock picks for 2025. These selections were made by Zacks Director of Research Sheraz Mian and have consistently shown success. Since 2012 through November 2024, the Zacks Top 10 Stocks achieved a remarkable gain of +2,112.6%, outperforming the S&P 500’s +475.6%. Sheraz meticulously analyzed 4,400 covered companies to identify the ten best to buy and hold for 2025. Take advantage of this opportunity to see these newly released stocks with great potential.

Check out the New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for your free report.

TechnipFMC plc (FTI): Free Stock Analysis Report

Oceaneering International, Inc. (OII): Free Stock Analysis Report

Baker Hughes Company (BKR): Free Stock Analysis Report

Liberty Energy Inc. (LBRT): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.