Spotify Set to Release Q3 2024 Earnings: Key Insights and Analysis

Spotify Technology S.A. (SPOT) is scheduled to announce its third-quarter 2024 financial results on November 12, following the market close.

Stay informed about quarterly earnings: Check out Zacks Earnings Calendar.

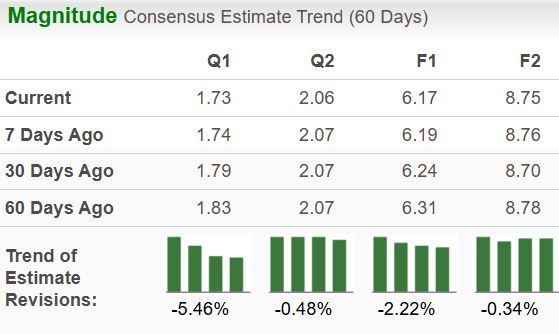

For the upcoming quarter, the Zacks Consensus Estimate predicts earnings at $1.73 per share, reflecting a significant year-over-year increase of 380.6%. Revenue expectations are set at $4.4 billion, which implies a 19.5% growth compared to last year.

In the past month, three estimates for this quarter have declined, while there have been no upward revisions. The earnings consensus for 2024 has seen a drop of 3.4% during the same timeframe.

Image Source: Zacks Investment Research

Spotty Earnings History

Spotify’s earnings history has shown some inconsistencies. Out of the last four quarters, the company fell short of the Zacks Consensus Estimate once while managing to exceed it three times, resulting in an average negative surprise of 4.3%.

Performance Metrics Overview

Spotify Technology price-EPS surprise | Spotify Technology Quote

Low Chances of an Earnings Beat

Current data suggests that an earnings beat for Spotify may be unlikely this quarter. Typically, a combination of a positive Earnings ESP (Expected Surprise Prediction) along with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) enhances the chances of better earnings. Unfortunately, Spotify’s Earnings ESP stands at -11.43%, accompanied by a Zacks Rank of #3. You can find today’s Zacks #1 Rank stocks here.

Growth Factors to Consider

One major factor likely influencing Spotify’s performance is the rise in subscribers and monthly active users (MAUs), which should positively impact both revenue and earnings.

The consensus estimate for total MAUs is anticipated to be 639.2 million, showing an 11.4% increase from the previous year. The estimate for ad-supported MAUs is projected at 402.1 million, also indicating an 11.4% growth. Furthermore, the premium subscriber count is expected to reach 250.97 million, reflecting an 11% year-over-year rise.

Recent Stock Performance

In terms of stock dynamics, SPOT has surged by 118% year to date, with increases of 38.3% over the last six months and 7.5% in the past month. This upward trend indicates that the stock may be in a rally phase.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Investment Insights

Spotify’s robust performance metrics have resulted from continued price increases, a loyal customer base, and effective cost management. These price hikes have enhanced the company’s revenue and profit margins, supported by a growing number of active users and premium subscribers.

Given these dynamics, SPOT is expected to deliver another solid quarterly performance, buoyed by subscriber growth and rising ARPU (Average Revenue Per User), both of which will likely improve the bottom line and strengthen the company’s balance sheet.

Other competitors in the streaming space, such as Alphabet’s GOOGL YouTube Premium, Apple’s AAPL Music/TV, and Amazon’s AMZN Music Unlimited, have also implemented price increases, reflecting a broader trend in the industry.

Final Thoughts

Although SPOT’s outlook seems promising, potential investors may want to hold off as the stock could face further corrections, particularly as it does not currently appear to be positioned for an earnings beat. Nevertheless, Spotify’s long-term growth potential remains strong, positioning it as an attractive stock to monitor for future investment opportunities.

Explore Top Clean Energy Stocks

Energy is crucial to our economy, comprising a multi-trillion dollar industry that has birthed many of the world’s largest enterprises.

Recent technological advancements are facilitating a transition toward clean energy sources, positioning them to outpace traditional fossil fuels. With trillions being invested in clean energy initiatives—from solar to hydrogen fuel—emerging leaders in this space could present exciting stock opportunities.

To discover Zacks’ top clean energy picks, download Nuclear to Solar: 5 Stocks Powering the Future free today.

Looking for the latest investment recommendations? You can also download 5 Stocks Set to Double at no cost.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.