Sterling Infrastructure’s Q3 2024 Earnings Report: What to Watch

Sterling Infrastructure, Inc. (STRL) will announce its third-quarter 2024 results on November 6, post-market.

Stay informed with all quarterly earnings: Check out Zacks Earnings Calendar.

In the previous quarter, STRL reported solid earnings, exceeding the Zacks Consensus Estimate by 16.8% for earnings and 5.3% for revenues.

The company experienced an 11.7% rise in revenue and a remarkable 31.5% increase in earnings per share (EPS). These gains were attributed to a diverse service portfolio aimed at expanding profit margins. Notably, gross margins reached a record 19.3%, while the backlog stood at $2.45 billion, reflecting a year-over-year increase of 2.2%.

Given these strong results and a sizable backlog, Sterling raised its 2024 outlook, anticipating 11% revenue growth, 28% net income growth, and 18% growth in EBITDA.

Sterling is a leading U.S. service provider in transportation, civil construction, and e-infrastructure, consistently surpassing earnings expectations. Over the past four quarters, the company has exceeded the consensus estimate each time, with an average surprise of 17.4%, as illustrated in the chart below.

Image Source: Zacks Investment Research

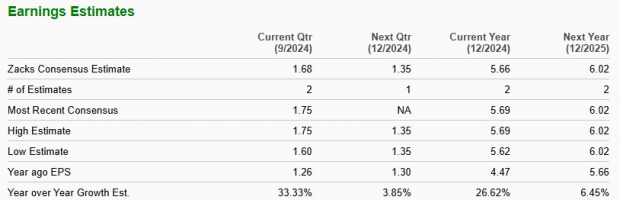

Understanding STRL’s Earnings Estimates

The Zacks Consensus Estimate for third-quarter EPS remains stable at $1.68, marking a double-digit growth compared to last year. The revenue consensus stands at $599.9 million, indicating a 7.1% year-over-year increase.

Image Source: Zacks Investment Research

Insights from the Zacks Model on Sterling

Unfortunately, our model does not indicate an expected earnings beat for Sterling this quarter. To achieve this, a stock must have both a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold), which is not currently met.

Earnings ESP: STRL shows an Earnings ESP of 0.00%. You can discover the best stocks to consider before they report using our Earnings ESP Filter.

Zacks Rank: The company currently holds a Zacks Rank #3.

Factors Impacting Sterling’s Q3 Performance

Sterling is set for growth in the third quarter as it capitalizes on long-term artificial intelligence (AI) trends and continues to diversify its offerings. The company is investing in areas like data centers and aviation, focusing on large, vital projects.

The E-Infrastructure segment, which is the largest and fastest-growing for STRL, made up 41% of the second-quarter 2024 revenues. Key clients include Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), Walmart Inc. (WMT), and Hyundai Motor Group. This segment will benefit from ongoing investments in data centers and advanced manufacturing, aligning with the rising demand for AI technology. Notably, data centers constitute 40% of STRL’s E-Infrastructure backlog, which signals strong future growth.

The Transportation Solutions segment, accounting for 40% of total revenues in the second quarter, is expected to see strong demand supported by federal and state funding through the Infrastructure Bill, which allocates $643 billion for transportation and $25 billion for airports over five years.

Sterling’s Building Solutions segment, responsible for 19% of second-quarter revenues, is focused on delivering concrete foundations for both residential and commercial projects in high-growth markets like Dallas, Houston, and Phoenix. While this segment employs a quick-turn, asset-light model leading to favorable cash cycles, it faces challenges including land prices and availability.

Strategic acquisitions have been essential for STRL’s growth, enhancing its service capabilities and driving revenues. Profitability is expected to improve due to reduced tax rates and lower interest expenses throughout the year.

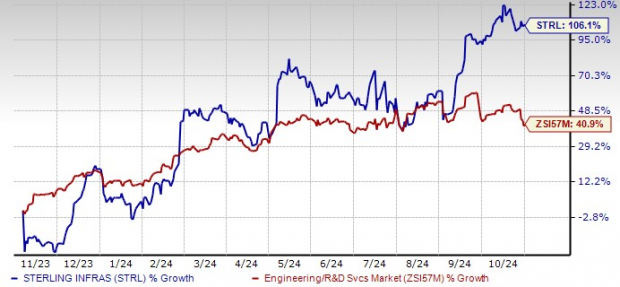

Examining STRL Stock’s Price Performance

STRL shares have climbed in value this year, outperforming the Zacks Engineering – R and D Services industry.

STRL’s Year-To-Date Price Performance

Image Source: Zacks Investment Research

Now let’s evaluate the current value STRL presents to investors.

Currently, STRL trades at a premium to the industry average, as indicated in the following chart.

Image Source: Zacks Investment Research

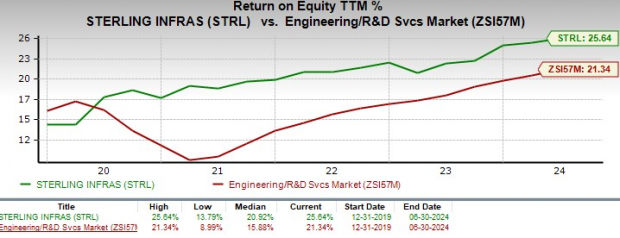

Moreover, STRL’s trailing 12-month return on equity surpasses the industry average.

Image Source: Zacks Investment Research

Investment Consideration: Is STRL a Buy, Sell, or Hold?

As the infrastructure sector expands, Sterling stands to gain substantially, owing to its robust industry reputation and extensive client experience. Currently, the capacity for data centers is insufficient to meet the growing demand fueled by AI and other emerging technologies.

Sterling’s 2024 midline guidance implies an 11% revenue increase, alongside a 28% rise in net income and an 18% growth in EBITDA. Although the company does not pay dividends, it invests significantly in organic growth, acquisitions, and stock buybacks. Operating cash flow has roughly doubled every two years, with revenue and EPS showing remarkable trajectories. From 2019 to 2023, EPS achieved a 38% compound annual growth rate. Given the positive forecasts for revenue and EBITDA for 2024, Sterling emerges as an appealing mid-cap stock with promising upside.

Yet, due to high valuations, minimal upward revisions in estimates, and a watchful market sentiment, investors might consider waiting for more definite signs of stability and favorable conditions, especially with upcoming elections on the horizon.

Expert Stock Recommendation: A Top Pick for Potential Growth

Among thousands of stocks, five Zacks experts have each chosen a favorite expected to soar by 100% or more in the coming months. From this selection, Director of Research Sheraz Mian has identified one stock with the most significant growth potential.

This company focuses on millennial and Gen Z markets, generating nearly $1 billion in revenue just last quarter. A recent dip offers an ideal entry point for investors. While past Zacks picks have had mixed success, this stock could outperform previous selections such as Nano-X Imaging, which surged by 129.6% in just over nine months.

Get the latest recommendations from Zacks Investment Research by downloading the report on 5 Stocks Set to Double.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.