Nvidia GTC 2025 Highlights: AI Demand Remains Strong Amid Economic Uncertainty

Nvidia (NASDAQ: NVDA) hosted its GPU Technology Conference (GTC) 2025 last month in San Jose, California. This annual gathering is recognized as a premier event focused on artificial intelligence (AI), a sector Nvidia continues to lead through its innovative chip technology.

Having watched CEO Jensen Huang’s two-hour keynote in real time, I also tuned in to his interviews and various panel discussions touching on AI and humanoid robots. The insights shared, especially during Huang’s keynote, were enlightening. It featured numerous promising product launches and strategic partnerships, further solidifying my positive outlook on Nvidia Stock as a solid long-term investment.

Where to invest $1,000 right now? Our analyst team recently revealed their picks for the 10 best stocks to buy at this moment. Learn More »

A Surprising Demand Outlook for AI During Recession

During the GTC Financial Analyst Q&A session on March 19, a Wall Street analyst posed an important question: “If there’s a recession, what does that do to your business? To AI demand?”

Huang responded, “If there’s a recession, I think that companies working on AI will shift even more investment toward it because it’s the fastest growing area. Every CEO will understand the need to focus on what is growing.”

This response suggests that even amid economic downturns, demand for Nvidia’s AI-enabled products may not only remain stable but potentially increase. In its latest quarter ending in January, these products accounted for at least 87% of Nvidia’s total revenue.

At first glance, Huang’s assertion might appear counterintuitive. However, it reflects the growing necessity for companies to invest in AI. In today’s rapidly evolving marketplace, firms that reduce their AI spending—even for a short period—risk falling behind competitors and potentially face severe long-term consequences.

For example, if Apple were to scale back on AI investments during an economic slump, it might risk permanently losing its iPhone customers to competitors utilizing Alphabet’s Android system—an alarming risk given the iPhone’s critical role in Apple’s portfolio.

As Palantir‘s CEO Alex Karp pointed out, the future will likely see a divide between those companies effectively leveraging AI and those that do not. The firms that embrace AI will thrive, while those that do not may struggle.

Nvidia’s Resilience in Economic Downturns

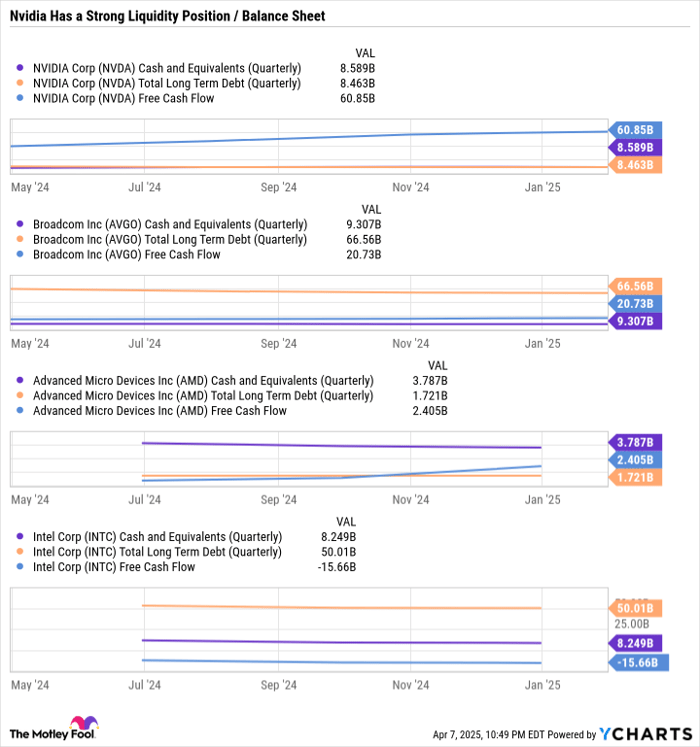

Data by YCharts. Data as of each company’s most recently reported quarter. Free cash flow numbers are for the trailing-12-month period.

What happens if AI demand decreases during a recession, as Huang suggested it might not? Investors can take comfort in Nvidia’s strong financial positioning. Unlike many competitors, Nvidia is well-equipped to handle dips in revenue, earnings, and cash flow.

The accompanying chart illustrates Nvidia’s health, showing that its cash and long-term debt are nearly equal, at about $8.5 billion each. In contrast, chipmaker Advanced Micro Devices (AMD) enjoys a favorable cash position compared to its long-term debt. On the other hand, companies like Broadcom and Intel have significantly more debt than cash, a situation that may strain their financial stability—especially with Intel facing a negative free cash flow of negative $15.7 billion over the last year, exceeding its cash reserves.

Notably, Nvidia is a free cash flow (FCF) powerhouse. The company generated $60.9 billion in FCF over the past year, providing ample opportunity to service its debt responsibly while pursuing long-term growth initiatives.

Considering an Investment in Nvidia?

Before making an investment in Nvidia Stock, consider this:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks to consider investing in right now; notably, Nvidia is not included in that list. These selections could yield significant returns in the upcoming years.

Consider the impact of Nvidia’s inclusion in the list on April 15, 2005… a $1,000 investment would now be worth $578,035!

Stock Advisor provides a blueprint for investment success, including portfolio guidance, analyst updates, and two new Stock picks each month. The Stock Advisor service has more than quadrupled the S&P 500 returns since 2002*. Don’t miss the latest top ten list, available to subscribers of Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 5, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Beth McKenna has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Intel, Nvidia, and Palantir Technologies. It also recommends Broadcom and short May 2025 $30 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.