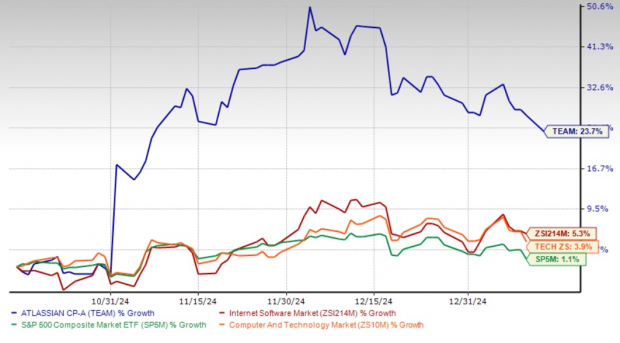

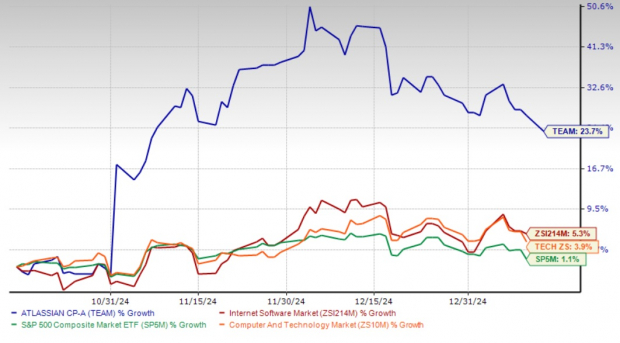

Atlassian has seen its shares climb by 23.7% over the last three months, surpassing the Zacks Computer Technology sector, the Zacks Internet Software industry, and the S&P 500, which returned 3.9%, 5.3%, and 1.1%, respectively. This growth indicates strong investor confidence in Atlassian’s position as a leader in enterprise collaboration and workflow software. As the stock price rises, investors are left wondering: Is it time to buy, hold, or sell Atlassian shares?

Cloud Services Propel Atlassian’s Growth

Atlassian is benefiting from the increasing digitalization and rapid adoption of cloud services by businesses. According to a report by Mordor Intelligence, the global enterprise collaboration market is expected to grow from approximately $66.79 billion in 2025 to around $111.02 billion by 2030, reflecting a compound annual growth rate (CAGR) of 10.7%. This growth presents Atlassian with significant opportunities to expand its offerings.

Atlassian’s Price Performance Over Three Months

Image Source: Zacks Investment Research

Atlassian is witnessing growth in its cloud migration efforts, which have been bolstered by the integration of artificial intelligence (AI) across its cloud platform. The company is pushing its latest cloud offerings, including Jira Product Discovery Premium, Compass Premium, and Guard Premium, to facilitate this migration.

Currently, TEAM is focused on enhancing its subscription-based offerings, a strategy that is resulting in stable revenue generation and better profit margins. Subscription services are typically high-margin, particularly as the cost to serve additional users decreases as the customer base expands. Subscriptions have emerged as Atlassian’s fastest-growing segment, achieving a CAGR of over 43% between fiscal 2020 and 2024.

These advancements are expected to provide significant value to TEAM’s customers, ultimately contributing to Atlassian’s revenue growth. The Zacks Consensus Estimate forecasts Atlassian’s fiscal 2025 revenues will reach $5.08 billion, representing a year-over-year growth of 16.64%. Additionally, the anticipated earnings per share for fiscal 2025 is $3.18, indicating an 8.5% increase from the prior year.

Atlassian Faces Short-Term Hurdles

Despite positive trends, Atlassian’s near-term outlook faces challenges stemming from reduced IT spending. Companies are delaying substantial IT investments due to a slowing global economy, influenced by macroeconomic and geopolitical uncertainties. This trend may negatively impact Atlassian’s near-term performance.

Though TEAM has established itself as a key player in collaboration and workflow software, it competes in a crowded market populated by giants such as Broadcom (AVGO), Microsoft (MSFT), Alphabet (GOOGL), Salesforce, and IBM. Atlassian’s JIRA faces competition from Broadcom’s Rally Software and Microsoft’s Azure DevOps, while its Confluence product competes with Salesforce Chatter and Google Apps for Work.

This intense competition has compelled Atlassian to increase its research and development (R&D) expenditures. Their R&D costs soared as the company invested more in AI technology to enhance product features. In the latest financial reporting for the first quarter of fiscal 2025, non-GAAP R&D expenses rose 23.7% year over year, outpacing revenue growth of 21.5%. This increase in R&D spending has affected profitability, leading to a 40 basis point contraction in its non-GAAP operating margin.

Moreover, the slowing growth rate of new customers has raised caution regarding Atlassian’s short-term prospects. The company’s customer growth experienced a CAGR of 14.7% between fiscal 2020 and 2024, significantly lower than the 30% CAGR seen between fiscal 2016 and 2020.

Zacks Rank Insights

Currently, Atlassian holds a Zacks Rank of #3 (Hold), suggesting that existing shareholders should maintain their positions while new investors may want to await a more favorable entry point. For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Free Guide: 5 Stocks Set to Thrive in the Infrastructure Boom

The U.S. government is allocating trillions of dollars for infrastructure improvements. This funding will support various projects, from roads and bridges to AI data centers and renewable energy ventures.

In this guide, you’ll find 5 surprising stocks positioned to benefit from the substantial growth and spending in this sector.

Download your free guide to learn how to capitalize on the trillion-dollar infrastructure opportunity.

For the latest recommendations from Zacks Investment Research, you can also download a report on the 7 Best Stocks for the Next 30 Days. Click to access this free resource.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.