Ron Finklestien

Anticipating Mohawk Industries’ Upcoming Earnings Report: Key Insights and Expectations

—

Mohawk Industries Set to Announce Q4 Earnings Amid Mixed Analyst Expectations Mohawk Industries, Inc. (MHK), founded in 1988 and based in Calhoun, Georgia, is ...

Devon Energy Earnings Forecast: Anticipated Insights and Trends

—

Devon Energy Prepares for Q4 Earnings Amid Market Challenges Company Overview and Upcoming Earnings Report Based in Oklahoma City, Oklahoma, Devon Energy Corporation (DVN) ...

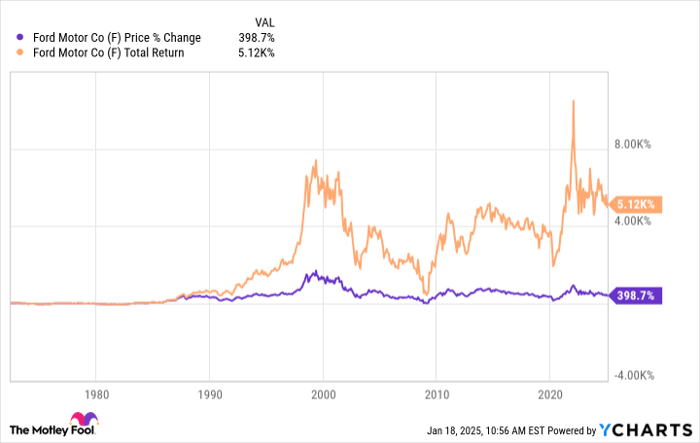

Assessing the Safety of Ford’s 6% Dividend Yield: What Investors Should Know

—

Assessing Ford Motor Company’s Dividend Amidst Financial Challenges Investors pondering shares of Ford Motor Company (NYSE: F) face important considerations before making decisions. Last ...