Ron Finklestien

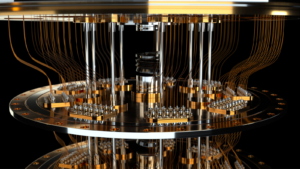

Quantum Computing Stocks Set to Propel February

Quantum Computing Stocks to Turn February into an Unforgettable Month

Seize the day. Now is the time to snag shares of quantum computing stocks while they hang at a modest valuation. These tech firms, ...

Citadel’s Bold Move: Doubling Down on SOFI Stock

Citadel’s Bold Move: Doubling Down on SOFI Stock

Source: shutterstock.com/Michael Vi SoFi (NASDAQ:SOFI) stock has stumbled more than 10% year-to-date, yet a major player in the investing world just unveiled its enlarged ...

Retains Strategic Foothold in the Competitive Hydrogen Market

For companies venturing into the sphere of hydrogen energies, risks are as prevalent as opportunities. The global hydrogen economy’s escalating trajectory through the decade is underscored by investors’ hopes for multibagger returns from hydrogen stocks. However, amidst the budding optimism lies a crucial distinction: not all hydrogen companies are created equal. A beacon of caution in this labyrinthine market is the sustained decline in the stocks of industry stalwart Plug Power (NASDAQ:PLUG), emphasizing the pivotal role of financing and execution risks. Astute navigation through the turbulent seas of hydrogen investments necessitates an exploration of blue-chip names that remain stalwart amidst the industry’s dynamic currents.

Air Products and Chemicals (APD): Navigating the Winds of Change

Source: Bjoern Wylezich / Shutterstock

The esteemed Air Products and Chemicals (NYSE:APD) stands as a venerable behemoth in the hydrogen domain, offering steadfast resilience and the promise of growth. Traversing a path less fraught with risk, APD stock trades at a forward price-earnings ratio of 17.7 and beckons with an enticing dividend yield of 3.25%. The company’s substantial investment of $15 billion in low-carbon hydrogen projects augurs well for its future trajectory, underscoring its financial robustness and unwavering commitment to the hydrogen economy.

Air Products’ foray into the creation of a blue hydrogen energy complex in Louisiana reinforces its mettle and ambition, poised to yield a prodigious 750 million standard cubic feet of blue hydrogen daily. Furthermore, the company’s investment of $500 million in a facility earmarked for the production of green liquid hydrogen in New York stands as a testament to its unwavering commitment to sustainable energy solutions and technological innovation. Beyond U.S. shores, Air Products’ NEOM Green Hydrogen complex in Saudi Arabia assumes paramount significance, setting the stage for the production of carbon-free hydrogen, heralding a challenging yet promising trajectory.

Linde (LIN): Nurturing the Seeds of Growth

Source: nitpicker / Shutterstock.com

Linde (NASDAQ:LIN) etches its mark as another lustrous gem in the hydrogen universe, offering a delightful blend of resilience and potential growth prospects. LIN stock’s alluring dividend yield of 1.23% is complemented by robust valuations, accentuating the company’s strategic positioning amidst the hydrogen renaissance.

The company’s resolute commitment to the hydrogen economy is exemplified by its announcement of an investment ranging between $7 to $9 billion in clean energy over the next two to three years. LIN’s claim to possess the world’s largest liquid hydrogen capacity and distribution system reflects its steadfast ambition and the potency of its infrastructure. The sprawling expanse of LIN’s operations across hydrogen production, processing, storage, and distribution underscores the company’s comprehensive dominion over the hydrogen value chain. LIN’s impressive financial performance, manifesting through a reported $2.7 billion in operating cash flow for Q3 2023, is a testament to its financial agility and the potential to spearhead groundbreaking investments in the hydrogen domain.

Chevron’s Strategic Footing in the Hydrogen Ecosystem

As the electric vehicle landscape becomes increasingly crowded, Chevron’s strategic foray into the hydrogen economy emerges as a compelling testament to the company’s foresight and adaptability. Amidst the burgeoning competition in the electric vehicle space, Chevron’s strategic diversification into hydrogen energies underscores the company’s keen acumen and adaptability. Its foray into hydrogen represents the company’s strategic fortification and adaptability, poised to cater to the evolving energy landscape. While the electric vehicle terrain becomes increasingly saturated, Chevron’s strategic embrace of hydrogen energies resonates as a strategic flourish, underscoring the company’s dynamism amidst the evolving energy ecosystem.

Chevron’s prescient anticipation of the hydrogen economy’s trajectory positions the company as a leader in the evolving energy paradigm, offering investors a strategic vantage point amidst the whirlwind of transformation within the energy sector. As the company continues to augment its strategic agility, Chevron’s diversified foothold in both the electric vehicle and hydrogen landscapes accentuates its strategic resilience and adaptability amidst the profound metamorphosis within the energy domain.

Diving into Chevron’s Financial and Strategic Moves Chevron (NYSE:CVX) continues to captivate the investment community with its resilient performance in the oil and gas ...

Michael Burry’s Q4 Investment Moves

Michael Burry’s Q4 Investment Moves

Source: Epic Cure / Shutterstock Michael Burry, the infamous investor known for being one of the first to bet against the housing market ahead ...

Bright Prospects for Consumer Stocks in 2024

Buckle Up! Here’s Why Three Consumer Stock Champions are Set for Soaring Growth in 2024

Consumer stocks are a rollercoaster ride for the faint-hearted. In a world grappling with inflation and stringent budgets, these stocks often bear the brunt ...

The Rise of Under-the-Radar E-commerce Stocks in a Booming Market

Source: William Potter/Shutterstock.com A few hours before composing this, I received a notification about packages at my door. It’s a recurring theme at our ...

Excitement Mounts: A New Era for Electronic Arts as NCAA College Football Game Nears Release

Excitement Mounts: A New Era for Electronic Arts as NCAA College Football Game Nears Release

Video game company Electronic Arts Inc EA announced in 2021 it was working on a college football video game, which excited many fans. After ...

AI Stock Predictions Unmask 3 Companies with 10X Potential

AI Stock Predictions Unmask 3 Companies with 10X Potential

InvestorPlace – Stock Market News, Stock Advice & trading Tips In a time when AI is a friend and a guide through complex financial ...

3 Construction Stocks to Consider as the Sector Flourishes

Construction Stocks Thriving Amid Booming Sector

A report from the American Institute of Architects highlighted the non-residential construction sector’s staggering expansion of approximately 20% in 2023, demonstrating remarkable resilience despite ...

Inflation-Resistant Stocks to Consider After Latest CPI Data

Inflation-Resistant Stocks to Consider After Latest CPI Data

On Tuesday, the market grappled with the news that the U.S. Consumer Price Index (CPI) revealed inflation rising faster than anticipated in January. As ...