“`html

Understanding Social Security: The Importance of Knowing Your Full Retirement Age

If you’re counting on Social Security during retirement, grasping how it functions is essential. Yet, the program can often seem complicated and perplexing.

Your full retirement age (FRA) is a key aspect to understand, as it directly impacts your benefit amount. Unfortunately, this is a common area of misunderstanding, and it could cost retirees around $4,560 each year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Image source: Getty Images.

Defining Your Full Retirement Age (FRA)

Your FRA is the age when you’ll receive your complete benefit amount based on your earnings history and career length. While you can apply before or after your FRA, doing so will affect the size of your monthly payments.

Many people aren’t aware of their FRA; a 2024 survey from the Nationwide Retirement Institute revealed that only 15% of adults could accurately identify it. Among individuals aged 50 and above, just 16% were aware of their FRA.

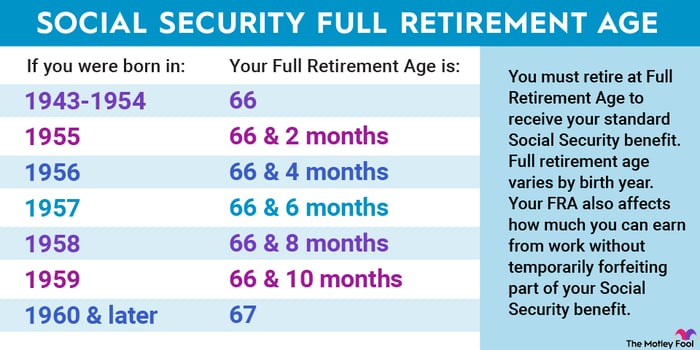

On average, adults guessed their FRA to be 61, while those aged 60 to 65 estimated it at 64. The earliest you can apply for Social Security is age 62, while the FRA typically falls between ages 66 and 67, depending on your birth year.

Image source: The Motley Fool.

This misunderstanding can lead to significant financial consequences. Applying early can lower your benefits substantially. Filing as early as possible may reduce your payments by up to 30%, and these reductions are permanent. Therefore, many people mistakenly file early, thinking they’re applying at their FRA and facing unexpected benefit reductions.

The average retiree receives around $1,925 monthly in benefits, based on November 2024 data from the Social Security Administration. If your FRA is 67 and you file at this age, you’d receive $1,900 monthly. However, if you believe your FRA is 64 and file at that age, your benefits would be reduced by 20% for filing three years early. This results in a $380 deduction per month or $4,560 annually.