AXIS Capital Holdings Dividend Overview

AXIS Capital Holdings announced a regular quarterly dividend of $0.44 per share ($1.76 annualized) on February 22, 2024, maintaining the same dividend as previously paid. To be eligible for this dividend, shares must be purchased before the ex-dividend date of March 1, 2024. Shareholders of record as of March 4, 2024, will receive the payment on April 18, 2024.

Historical Context of Dividend Yield

Reflecting on the past five years, the average dividend yield for AXIS Capital Holdings has been 3.20%, with a range from 2.40% to 4.69%. The current dividend yield of 2.81% stands 0.90 standard deviations below this historical average. This metric provides valuable insight into the company’s dividend performance and investor returns over time.

Understanding Dividend Payout and Growth

The company’s dividend payout ratio of 0.40 indicates that a significant portion of its income is distributed to shareholders. With a 3-Year dividend growth rate of 0.05%, AXIS Capital Holdings has demonstrated incremental increases in its dividend payments, showcasing a commitment to steady dividend growth.

Insights into Fund Sentiment and Analyst Forecasts

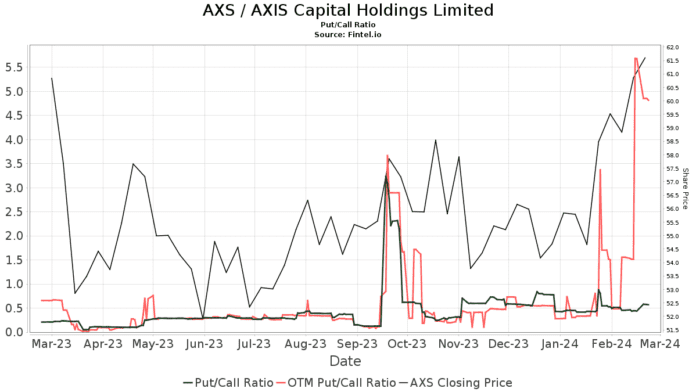

Currently, 738 funds or institutions hold positions in AXIS Capital Holdings, representing a notable increase in ownership over the last quarter. Analysts predict a 15.07% upside potential for the stock, with an average one-year price target of 72.08. Furthermore, the company’s projected annual revenue and non-GAAP EPS suggest positive growth trends for the future.

Stone Point Capital, T. Rowe Price Investment Management, American Century Companies, and Vanguard Total Stock Market Index Fund Investor Shares are among the significant shareholders of AXIS Capital Holdings, each displaying unique changes in ownership and portfolio allocations. These movements reflect the diverse strategies employed by institutional investors in managing their positions.

Discovering AXIS Capital Holdings

As the holding company for AXIS group of companies, AXIS Capital Holdings provides a range of risk transfer products and services globally. With operations spanning multiple regions, the company offers various insurance and reinsurance services, catering to diverse industry segments and risk profiles.

Exploring Fintel and Investment Research

Fintel serves as a comprehensive investing research platform that offers a wealth of data and insights for individual investors, traders, and financial professionals. From ownership data to fund sentiment and quantitative models, Fintel provides a wide array of tools to enhance investment decision-making and uncover profitable opportunities.

Original story featured on Fintel.