General Mills Gets a Boost from B of A Securities

On December 13, 2024, Bank of America Securities raised its rating for General Mills (BRSE:GIS) from Neutral to Buy.

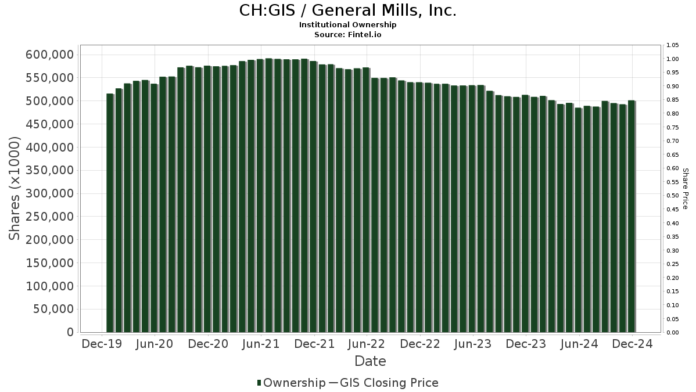

Fund Sentiment Around General Mills

A total of 2,404 funds or institutions have reported holding positions in General Mills. This is an increase of 72 owners, or 3.09%, compared to the previous quarter. The average portfolio weight of all funds invested in GIS rose to 0.22%, reflecting a 2.64% increase. However, total shares owned by institutions fell by 2.77% in the past three months, now totaling 501,109K shares.

Capital Research Global Investors currently holds 18,202K shares, which equates to a 3.28% stake in the company. This is down from 19,637K shares, representing a decrease of 7.88%. Interestingly, the firm increased its allocation in GIS by 2.50% over the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 17,667K shares, or 3.18% of General Mills. This indicates a slight drop, with its previous holdings being 17,861K shares, showing a decrease of 1.10%. Nonetheless, the firm enhanced its portfolio allocation in GIS by 8.45% in the last quarter.

Meanwhile, Vanguard 500 Index Fund Investor Shares (VFINX) holds 14,579K shares, translating to 2.63% ownership of the company. This reflects a modest increase from its prior holdings of 14,490K shares, or an increase of 0.61%. The firm also upped its allocation by 8.09% in the past quarter.

Geode Capital Management possesses 14,352K shares, amounting to 2.59% ownership. Its prior holdings were 14,335K shares, which marks a slight increase of 0.11%. However, this firm decreased its overall portfolio allocation in GIS by 43.54% during the last quarter.

Finally, AMRMX – AMERICAN MUTUAL FUND holds 12,645K shares, representing 2.28% of General Mills. This is a significant reduction from its prior 15,039K shares, which indicates a decrease of 18.94%. This fund also reduced its allocation in GIS by 25.66% over the last quarter.

Fintel is regarded as a top-tier research platform for investors, traders, financial advisors, and small hedge funds. They provide extensive data that includes fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and more. Their exclusive stock picks leverage advanced quantitative models aimed at enhancing profitability.

This story initially appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.