B. Riley Securities Initiates Coverage of Nayax with Mixed Outlook

Fintel reports that on November 19, 2024, B. Riley Securities began coverage of Nayax (NasdaqGS:NYAX) with a Buy recommendation.

Analyst Price Target Indicates Significant Decline

As of October 22, 2024, Nayax’s projected average price target for the next year is $0.22 per share. Predictions vary, with a low of $0.22 and a high of $0.23. This average suggests a striking decrease of 99.19% from the most recent closing price of $27.28 per share.

A look at companies with the largest price target upside can be found in our leaderboard.

Projected Financial Performance

Nayax’s anticipated annual revenue stands at $309 million, reflecting a modest increase of 5.97%. The projected annual non-GAAP earnings per share (EPS) is -0.09.

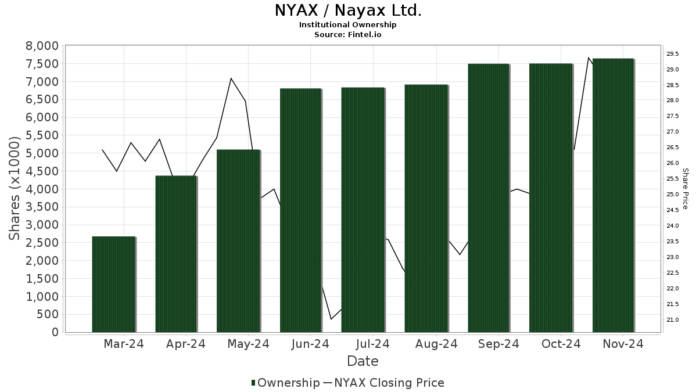

Assessing Fund Sentiment

Currently, 66 funds or institutions report positions in Nayax, a number that has remained stable over the previous quarter. The average portfolio weight of all funds invested in NYAX is 0.31%, showing an increase of 10.14%. Total institutional shares have risen by 1.04% in the last three months, amounting to 7,645,000 shares.

Institutional Investment Movements

The SMALLCAP WORLD FUND INC (SMCWX) owns 1,075,000 shares, translating to 2.96% of the company, with no changes in its holdings over the last quarter.

Similarly, Capital World Investors holds 1,075,000 shares, also representing 2.96% ownership, without any changes noted in the last quarter.

Franklin Resources owns 892,000 shares, making up 2.46% of Nayax. Their latest filing revealed a decrease from 898,000 shares, marking a decline of 0.61%. Furthermore, the firm cut its portfolio allocation in NYAX by 80.46% over the previous quarter.

Y.D. More Investments, holding 830,000 shares, has increased its stake by 17.66% from the prior 683,000 shares. Nevertheless, the firm has reduced its portfolio allocation in NYAX by 21.55% recently.

Clal Insurance Enterprises Holdings maintains its position with 665,000 shares, which is 1.83% ownership, showing no change in holdings over the last quarter.

Fintel is a leading investment research platform for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses global financial insights, including fundamentals, analyst reports, ownership statistics, fund sentiment, options analysis, insider trading, options flow, unusual options trades, and more. We also provide exclusive stock picks driven by advanced, backtested quantitative models for enhanced profitability.

Click to Learn More

This article was originally published on Fintel.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.